WASHINGTON - Prices of exchange-traded funds with outsize exposure to Nvidia plunged on Monday in reaction to news that a Chinese startup has launched a powerful new artificial intelligence model.

Technology market insiders like venture capitalist Marc Andreessen have labeled the emergence of year-old DeepSeek's model a "Sputnik moment" for U.S. AI companies, most of whose share prices slid on news that downloads of DeepSeek already have overtaken those of U.S. rival ChatGPT on Apple's online app store.

While Nvidia's share price traded about 17.3% lower by midafternoon on Monday, prices of exchange-traded funds that offer leveraged exposure to the chipmaker plunged still further.

The four ETFs that offer daily returns of double the gain in Nvidia were hit with the biggest decline, with the GraniteShares 2x Long NVDA Daily ETF, opens new tab nosediving 34.5%. Its leveraged inverse counterpart, which offers investors a gain of double any losses in Nvidia's stock, soared nearly 34%.

"These movements were to be expected, given what we saw happen with Nvidia," said Will Rhind, founder and CEO of GraniteShares. "We won't begin to get a sense of how much we're seeing in outflows or inflows until after the market is closed, though."

Other leveraged ETFs with large Nvidia exposure made equally dramatic moves. The ProShares Ultra Semiconductors ETF, which targets a return double that of the Dow Jones U.S. Semiconductors Index and has more than 40% of its assets in Nvidia, tumbled 24.43% by midday on Monday. Those ETF providers could not immediately be reached for comment.

"Volatility is what the gamblers in single-stock ETFs are looking for," said Bryan Armour, ETF analyst at Morningstar. "Those that have a bad experience now might shy away in future, but I’m sure they’ll be replaced by others."

The leveraged ETFs, which carry relatively high fees of close to 1% compared with about 0.4% for a typical actively managed ETF, are the domain of retail traders and speculators, Armour added.

But other ETFs were caught up in the selling, including many owned by institutions and retail investors with a longer investment time horizon.

For instance, the Vanguard Information Technology Index Fund traded down 5.25% by midafternoon on Monday. Nvidia is the fund's second-largest holding, at nearly 15% of the portfolio.

The VistaShares Artificial Intelligence Supercycle ETF lost about 10% by midafternoon. It has a smaller exposure to Nvidia - only 3% - but owns a wide variety of other AI stocks.

"Innovation and competition emerging in something as early-stage and dynamic as AI is not that surprising," said Adam Patti, co-founder and CEO of VistaShares. "The market will have to sort itself out over the months and years, as to what works and what will prevail."

The rapid growth of AI enthusiasm sent assets in the VistaShares ETF - launched only seven weeks ago - to more than $3 million by Friday, the firm said. The 2x GraniteShares Nvidia ETF - the largest of the leveraged funds - had $5.3 billion in assets as of Friday, according to data from VettaFi, accounting for about half of GraniteShares' total assets.

"This has been a little painful, but interesting," said Evan Feagans, who manages the $74 million TCW Artificial Intelligence ETF, opens new tab, which has an 8.5% weighting in Nvidia.

"It has been a 'shoot first, ask questions later' kind of response to the DeepSeek news, but I think moves like this create opportunities. I'd expect to hear some of the biggest investors in AI reiterate their AI capital spending outlooks after they report earnings numbers."

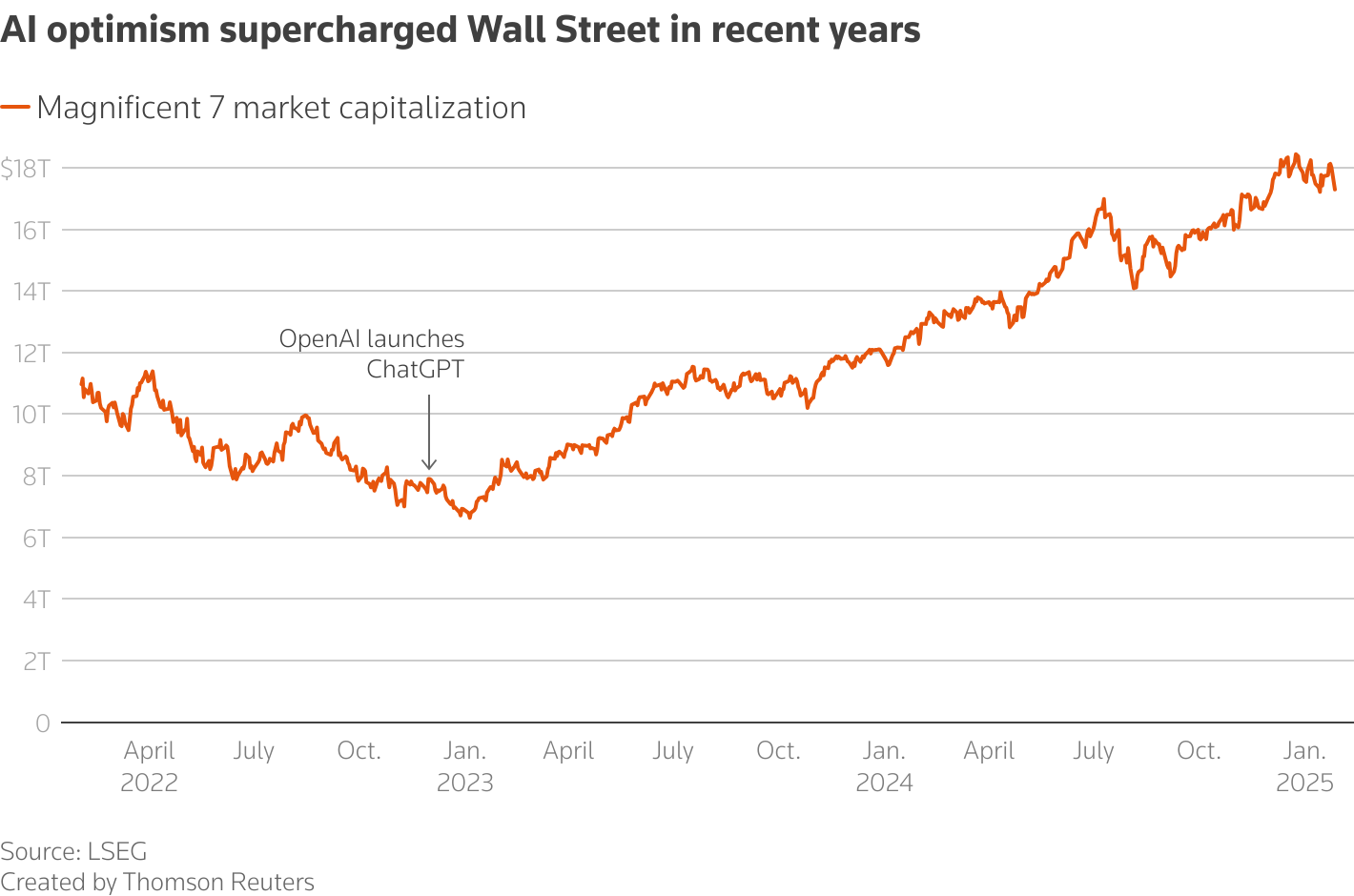

AI optimism supercharged Wall Street in recent years

|

The selloff follows a week in which investors "aggressively" unloaded holdings in leveraged technology ETFs, said research firm EPFR in its weekly analysis.

The firm said these ETFs recorded the second-largest weekly outflow on record, of $1.8 billion, with investors selling $400 million in leveraged Nvidia exposure alone.

Data for any outflows from these and other AI-themed ETFs on Monday is not available until Tuesday.