Coal developers risk wasting more than US$600 billion because it is already cheaper to generate electricity from new renewables than from new coal plants in all major markets, the financial think tank Carbon Tracker warns in a report on Thursday.

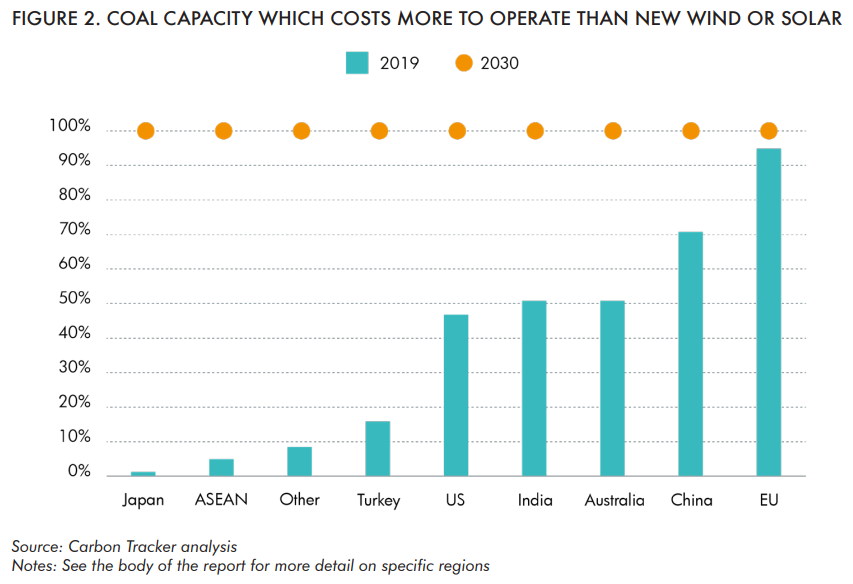

The report also finds that over 60 percent of global coal power plants are generating electricity at higher cost than it could be produced by building new renewables. By 2030 at the latest, it will have been cheaper to build new wind or solar capacity than continue operating coal in all markets.

“Renewables are outcompeting coal around the world and proposed coal investments risk becoming stranded assets which could lock in high-cost coal power for decades," Matt Gray, Carbon Tracker co-head of power and utilities and co-author of the report, was quoted as saying in a press release.

"The market is driving the low-carbon energy transition but governments aren’t listening. It makes economic sense for governments to cancel new coal projects immediately and progressively phase out existing plants.”

Limiting global warming to 1.5 degrees Celsius – a temperature target set out in the 2016 Paris Agreement – will require global coal use in electricity generation to fall by 80 percent from 2010 to 2030, according to a 2019 Climate Analytics report. This means one coal plant needs to retire every day until 2040.

Worldwide, 499 gigawatts of new coal power is planned or already under construction at a cost of $638 billion, but Carbon Tracker warns that governments and investors may never recoup their investment because coal plants typically take 15 to 20 years to cover their costs.

The report finds that falling costs of wind and solar power and the investment needed to comply with existing carbon and air pollution regulations mean that coal is no longer the cheapest form of power in any major market.

The report, entitled 'How to waste over half a trillion dollars: The economic implications of deflationary renewable energy for coal power investments,' evaluates the economics of 95 percent of coal plants that are operating, under construction or planned worldwide.

They include 6,696 operating units (2,045GW) and 1,046 units in the pipeline (499GW).

The U.S. has 254GW of coal capacity and nearly half – 47 percent – costs more than new renewables. No new coal is planned.

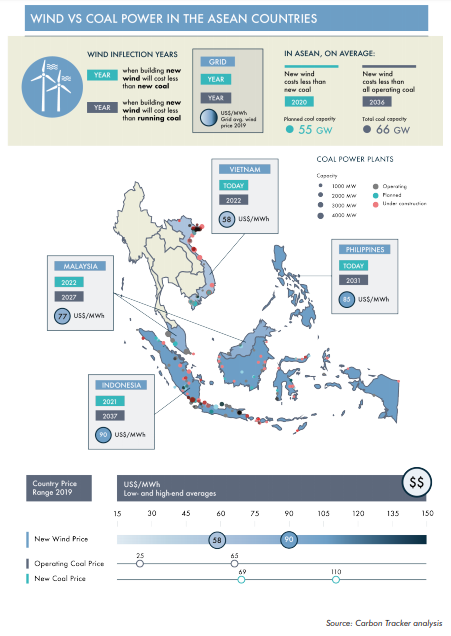

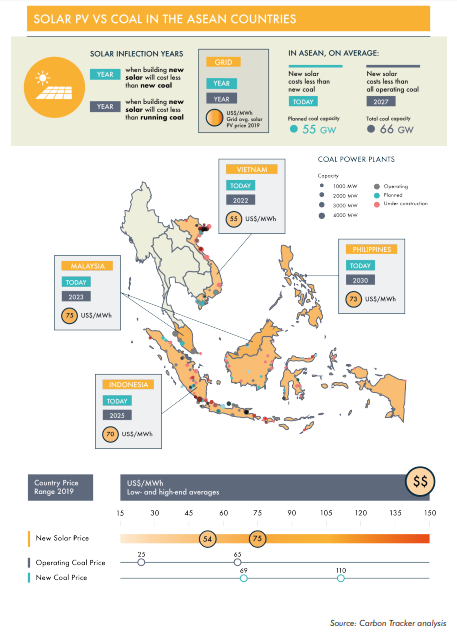

In Southeast Asia, 78GW of coal power is planned or under construction at a cost of $124 billion, but by 2030 it will have been cheaper to build new renewables than continue operating existing coal plants.

|

|

The report will provide ammunition for the growing number of investors pressing financial institutions and companies to align their portfolios with the Paris climate agreement.

This month, Sir Christopher Hohn, the billionaire hedge fund manager and co-founder of the Children’s Investment Fund Foundation (CIFF), called on major EU and UK central banks and financial institutions to end financing of coal and threatened to sue Barclays, HSBC and Standard Chartered if they continue financing new coal projects.

“Coal is the single largest source of greenhouse gas emissions globally and the risks of its continued use in the power sector are not being adequately addressed by regulators and the financial system,” he said in a statement on the CIFF website.

Coal is closest to becoming obsolete in the EU thanks to a strong carbon price and years of investment in renewable energy. Excellent renewable energy resources in the U.S., low capital costs in China and least-cost policymaking in India, mean they are not far behind.

Southeast Asian countries lag behind because immature energy markets make it hard to attract global finance, and governments in China, Japan and South Korea continue to support investment in coal power.

|

|

The report finds that market forces will drive coal power out of existence in deregulated markets, where renewable energy developers will take advantage of the growing price gap.

However, it notes that several governments around the world continue to incentivize and underwrite new coal power because market regulations put coal at an unfair economic advantage.

In some regulated and semi-regulated markets they also allow the high cost of coal to be passed on to consumers through bills, or they use taxpayers’ money to subsidize coal operators so they can sell power for less than it costs to produce.

“Investors should be wary of relying on continued government support for coal when a phase-out will save their voters billions and make their economies more competitive,” Sriya Sundaresan, co-head of power and utilities and co-author, was quoted as saying in the Carbon Tracker press release.

The report calls on governments to deregulate so that renewables can compete with coal on a level playing field, cancel new projects and phase out existing coal fleets, and introduce regulations that allow renewables to deliver maximum value to their energy systems.

“Failure to take these steps will exacerbate stranded asset risk and could result in overcapacity. This in turn will suppress power prices, create a negative investment signal for renewable energy and ultimately stifle the transition to a low carbon economy," the report warns.

|

|

Carbon Tracker compared the levelized cost of onshore wind and utility-scale solar PV with the levelized cost of coal and the long-run marginal cost of coal.

It assessed the cost of running each coal plant, taking into account fuel, maintenance and existing or ratified carbon pricing and air pollution policies. It used coal fuel price data from Bloomberg and coal capital costs from the International Energy Agency and Carbon Tracker.

It sourced wind and solar capital costs and deployment projections from the International Renewable Energy Agency.

Carbon Tracker’s proprietary Global Coal Power Economics Model (GPEM) tracks 95 percent of coal plants that are operating, under construction or planned and is updated quarterly.

Like us on Facebook or follow us on Twitter to get the latest news about Vietnam!