Although Vietnamese people are embracing the advantages of cashless payment, cash possession remains high in the country as a lack of acceptance points is holding the country back from moving towards a cash-free society.

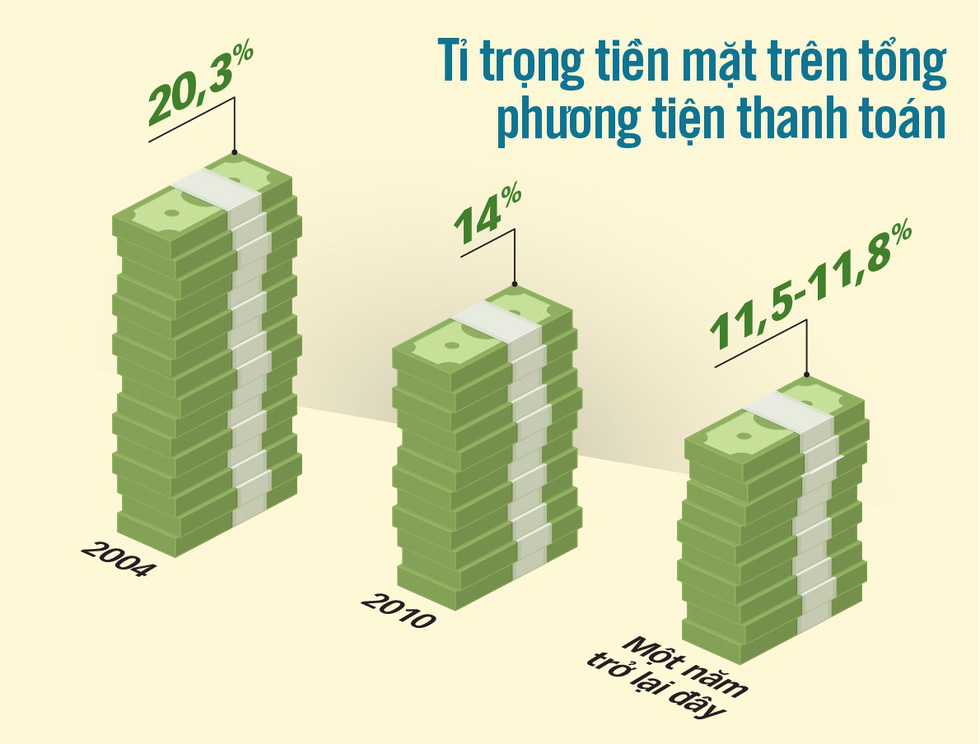

Cash used for payment in Vietnam decreased from 20.3 percent in 2004 to 11.5 percent last year.

Both banks and individuals undeniably benefit from this cashless trend, according to experts in the field.

Banks benefit from cashless societies by saving costs on automatic teller machines (ATMs), rental fees for ATM premises, guarantee services, and transportation.

A leader of a Hanoi-based commercial bank told Tuoi Tre (Youth) newspaper that around six million of transactions, both cash and cashless, are conducted through his bank on a monthly basis, contributing to VND190 trillion (US$8.17 billion) in payment revenues during the first four months of this year.

“Assume that my bank can save five percent of this revenue by moving towards cashless payment, those funds can be redirected towards investments in technology,” the leader said.

|

| The proportion of cash used in payments in Vietnam |

Individuals are able to benefit from going cashless by saving time and money through faster and more secure transactions.

On a larger scale, cashless payments create faster capital flows, reduce the management and issuance costs of physical money, and cut opportunities for criminals to exploit.

According to a figure released by the State Bank of Vietnam earlier this year, stopping the issuance of VND500, VND 1,000, and VND5,000 banknotes over the past five years alone helped the state budget save VND2,590 billion ($111.37 million).

The embrace of cashless payment also helps reduce lost tax revenue, according to Dao Minh Tuan, deputy general director of local lender Vietcombank.

|

| A customer pays via a mobile device at an eatery in Ho Chi Minh City. Photo: Quang Dinh / Tuoi Tre |

However, in parallel with the cashless movement, cash availability for Vietnam’s population of 94 million remains high at VND1 quadrillion ($43 billion), meaning each Vietnamese holds more than VND10 million ($430) in personal cash savings.

Experts blame the situation on a lack of acceptance points for cashless payment.

Currently, from such daily activities as shopping, buying gasoline, periodic payments for school fees and waste collection, and rare events like registration and license plate fees for new motorbike, Vietnamese people have no choice but to pay in cash because non-cash payments are not accepted.

“For now, people cannot completely ditch cash, even if they want to,” said Minh Thu, a resident in Ho Chi Minh City’s Phu Nhuan District.

Like us on Facebook or follow us on Twitter to get the latest news about Vietnam!