Siam Cement Group (SCG), Thailand’s leading industrial conglomerate, announced its business performance in Vietnam for the year 2024, posting a record revenue of VND35.14 trillion (US$1.4 billion).

This marks a 15-percent increase compared to 2023, largely driven by the operations of Long Son Petrochemicals Company Limited, SCG’s flagship petrochemical project in Ba Ria - Vung Tau Province, southern Vietnam.

In the final quarter of 2024, SCG's revenue from Vietnam reached VND9.18 trillion ($363 million), reflecting a seven-percent year-on-year increase.

According to the Thai giant, this growth was primarily fueled by its subsidiary SCG Chemicals' petrochemical exports, particularly polyethylene shipments from Thailand to Vietnam.

Beyond Vietnam, SCG recorded a 12-percent revenue increase across ASEAN (excluding Thailand) in 2024, with total earnings reaching VND97.26 trillion ($3.88 billion).

The Vietnamese market was identified as a key driver of this regional growth, contributing significantly across all business segments, including construction materials, packaging, and petrochemicals.

SCG’s total global revenue for 2024 stood at VND362.73 trillion ($14.49 billion), reflecting a two-percent annual growth.

However, its after-tax profit plunged 76 percent year on year to VND4.5 trillion ($180 million), mainly due to operational challenges at Long Son Petrochemicals and lower contributions from affiliated companies.

Without extraordinary factors from 2023, such as asset write-offs in its regional cement plants and fair value adjustments in investments, SCG's 2024 profit would have declined by 52 percent instead.

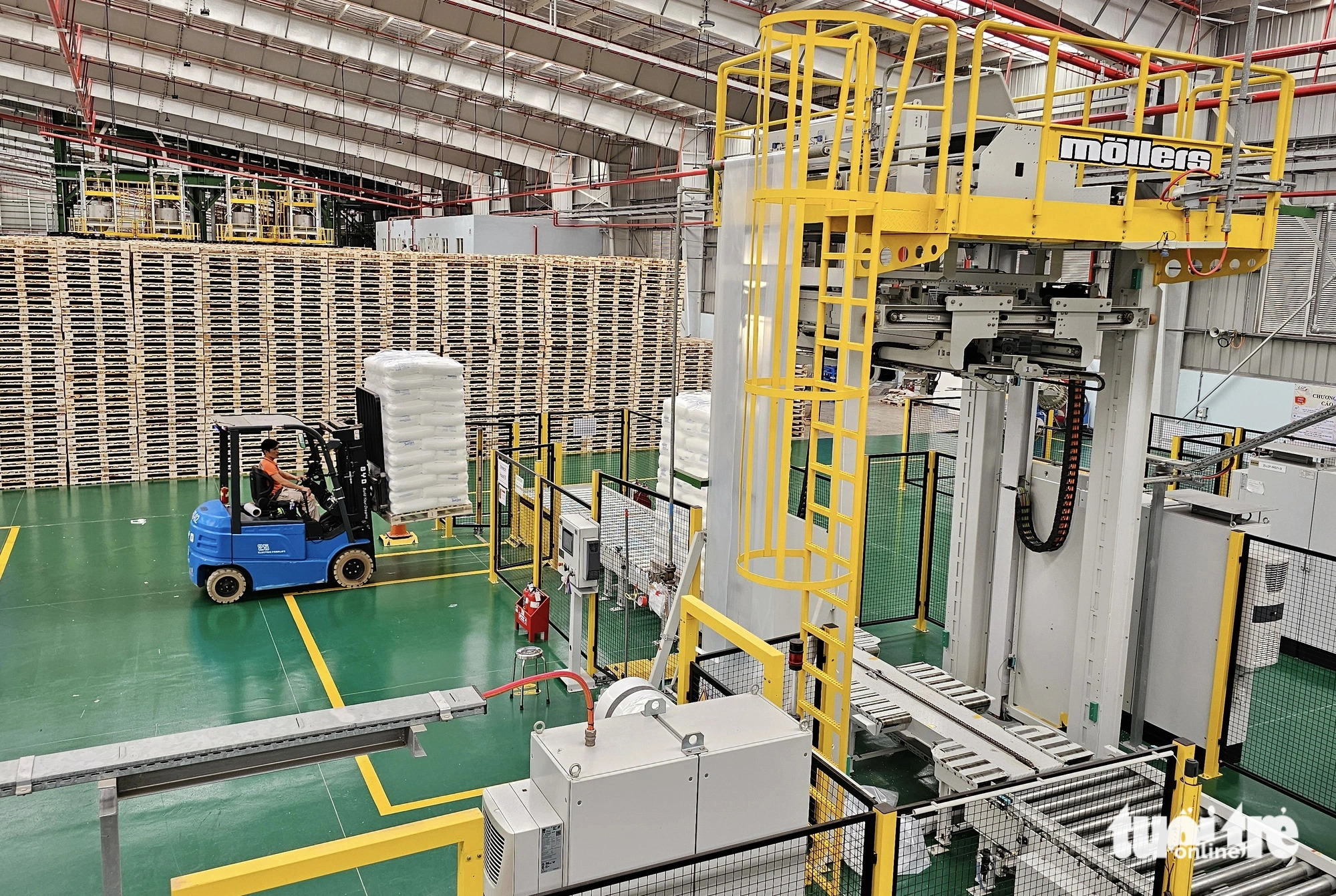

In Vietnam, SCG's $5-billion Long Son Petrochemicals complex, which officially commenced operations on September 30, 2024, has been a high-profile investment in the country’s industrial sector.

However, due to unfavorable market conditions, SCG temporarily suspended commercial operations at the facility in late 2024.

Speaking to Tuoi Tre (Youth) newspaper, an SCG representative confirmed that the halt was necessary to manage operating costs, with plans to restart production once market conditions improve.

SCG also committed $700 million to upgrade the complex, ensuring more cost-efficient raw materials when operations resume.

Having entered the Vietnamese market in 1992, SCG has grown into one of the largest foreign investors, mainly through mergers and acquisitions.

SCG now operates 27 subsidiaries in Vietnam, employing over 16,000 workers across industries such as construction materials, packaging, and petrochemicals.

Notable Vietnamese subsidiaries under SCG include Vietnam Construction Material Company JSC, Song Gianh Cement JSC, and Binh Minh Plastics.

In the packaging sector, SCG holds major market shares in paper, woven, consumer, and food packaging via subsidiaries like Duy Tan, BATICO, and SOVI.

SCG has also positioned itself as a leader in green innovations, actively introducing low-carbon, sustainable products in Vietnam.

Like us on Facebook or follow us on X to get the latest news about Vietnam!