Since publishing the story “Savings disappear without a trace after 31 years” late last week, Tuoi Tre continues to receive information from many readers about their savings books which have been kept since the 1980s.

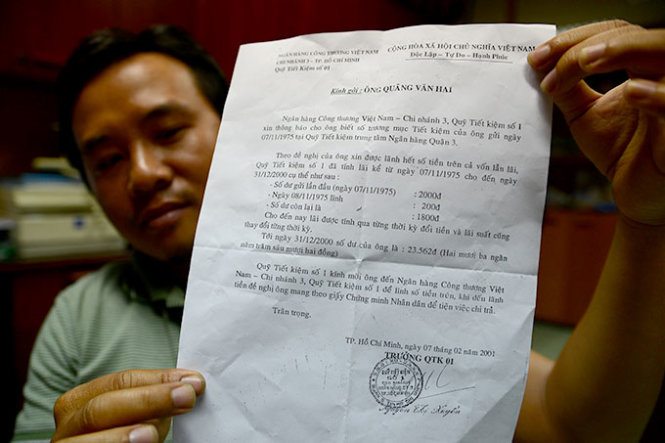

One of the most noteworthy cases among them is the story of Quang Van Hai, from Binh Thanh District, Ho Chi Minh City, who realized his savings, worth some 2 taels of gold bullion, or 75 grams of gold, which is currently valued at roughly VND70 million (US$3,300), decreased to VND23,562, or just over $1, in 2000.

Devaluing over time

Quang Hung Minh, Hai’s son, told Tuoi Tre the story of his father, who deposited VND1,800 of old money on November 8, 1975, (after the country had unified on April 30, 1975.)

“VND1,800 in 1975 was quite a big sum of money. At that time, gold bullion was worth around VND900 per tael,” Huynh Van Hiep, a reader, told Tuoi Tre.

Minh, who also lives in Binh Thanh District, said in 2001, after visiting many financial institutions related to Hai’s savings, Minh was directed to branch No.3 of the Vietnam Commercial Joint Stock Bank for Industry and Trade (VietinBank) in Ho Chi Minh City. The branch was assigned as the unit which will repay Hai’s savings.

However, the VietinBank branch said the savings account balance of Minh’s father was VND23,562 as of December 31, 2000.

This was calculated based on the amount of interest rate fluctuation over time, including the period when the old money was changed to new currency.

In 1985 the state launched a national money-changing campaign which exchanged the old VND10 for the new VND1.

"We were astonished to receive this information. The remaining money isn’t even enough for the transportation cost for my father to go there to get the money back, so he decided to abandon it. He still keeps the letter from the bank as a souvenir," he said.

Many readers also showed sympathy for Thuy, whose savings, which were worth 7.5 grams of gold in 1983, or around VND7 million at the current price, vanished after a national money-changing campaign.

Reader Minh Khang also said his family had two savings book from 1979 to 1985, so his family understands the value of money during that period.

"There's a very funny story that in late 1980 I won a lottery worth VND1, which was enough to cover snacks for 15 people in my working group. But I decided to deposit the money into a bank. Years passed, and when I returned to the bank for the money recently, the bank teller just looked at me and the savings book and said sorry.”

Reader Khanhnd8 said: "I remember how a French bank with an office on Trang Thi Street in Hanoi repaid a customer with savings from 1953 a few years ago. The amount paid is calculated based on the principal plus an annual inflation rate of corresponding maturity tenor at an annual constant. As a result, after more than 50 years, the value of the savings book was unchanged.”

Banking principles to be maintained Currently, depositing via savings is one of the important operations of a bank, which is also a channel to mobilize financial resources for the economy, said financial expert Dinh The Hien.

According to Hien, previously most people deposited their money or bought government bonds as their contribution to nation building, so they did not care much about the interest rate and its fluctuations.

In principle, the bank which issued a savings book must be responsible for storing and verifying the records and documents in order to guarantee payments, though people may forget about their deposits for a long period. The repayment based on the accrued interest rates plus the principal must be correct.

The principals of the financial market are always clearly defined, so whether depositors have forgotten for five years or more than 10, the benefits are guaranteed.

In fact, due to currency devaluation, the value of savings books decreases over time without the care of depositors, who rarely update the information on their deposits and make timely adjustments or withdrawals, Hien said.

The director of a commercial bank also recognized many people deposited money during the period of historical volatility (1975-1990), when many deposits lost significant value. The question now is how to repay depositors so that they feel the bank helps them share the losses.

Many local economists also said that currently people deposit their money for the main purposes of savings and gaining profits. As a result, bank deposit rates have been more and more closely adjusted for inflation.

"Consumers may complain of low interest rates but their deposits should be guaranteed to profit, even in the face of inflation. The financial institutions in Vietnam’s market are gradually improving, and banks compete more, so Thuy’s case may not happen again," Hien said.