The State Bank of Vietnam, which is the country’s central bank, has issued a new fiat to restrict an e-wallet user’s monthly transactions to no more than VND100 million (US$4,324).

This payment cap is stipulated in Circular 23/2019/TT-NHNN dated November 22.

The order will take effect on January 7, 2020.

A user’s transactions to pay for legitimate goods and services and tranfer money between e-wallets powered by the same company are limited to VND100 million a month, according to the circular.

The central bank has crossed out a proposed article capping the transactions’ value at VND20 million ($865) a day.

Such abolition of a daily cap will spur cashless payment, e-wallet service providers said.

The fiat also requires that users top up their e-wallets via checking accounts, debit cards, or transfers from their peers, who use the same e-wallet service.

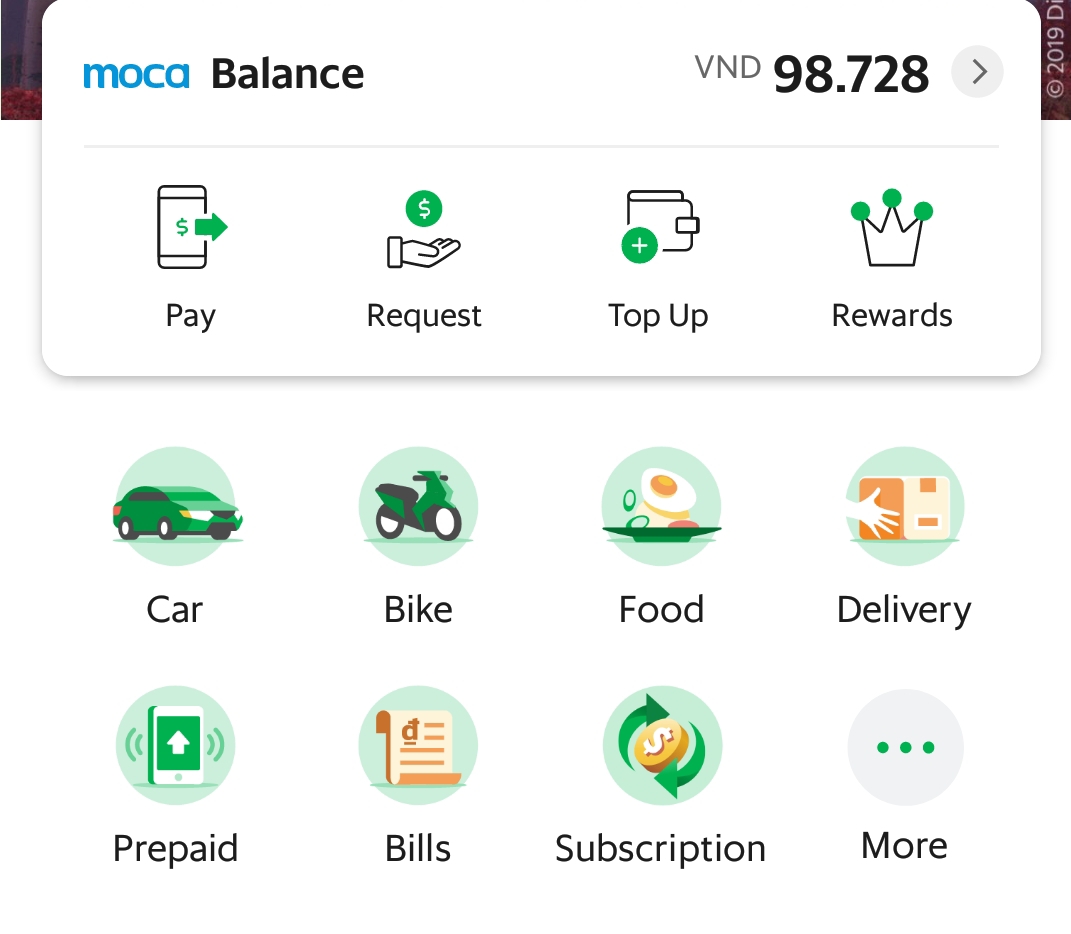

Users are permitted to use e-wallets to pay for goods and services, transfer money to other users, and credit their checking accounts or debit cards with money withdrawn from their e-wallets.

The State Bank of Vietnam bans the use of e-wallets to launder money, sponsor terrorism, cheat, and commit other violations.

The central bank also prohibits leasing or lending e-wallets, as well as trading e-wallet information.

E-wallet service providers are forbidden from granting credit to users, pay interest on the balance in their accounts, or taking any action that may increase the amount of money with which the users top up their wallets.

Cashless payment is on the rise in Vietnam as more and more people use e-wallets to pay for groceries, taxi fares, phone and electricity bills, water supply, and plane tickets.

Vietnam currently has 30 e-wallet service providers licensed by the central bank, including MoMo, Moca, ZaloPay, VNPay, Monpay, and ViettelPay, according to the World & Vietnam Report, the official press agency of the Vietnamese Ministry of Foreign Affairs.

Like us on Facebook or follow us on Twitter to get the latest news about Vietnam!