After Vietnam's tax authorities enhanced the collection of taxes from traders on digital platforms, including social networks and e-commerce sites, many traders are seeking ways to avoid paying them or pass the buck to buyers.

Shopping on websites, e-commerce platforms, and social networks is a national trend.

E-commerce has boomed in Vietnam with revenue of some US$13.7 billion in 2021.

The figure is forecast to reach $39 billion by 2025.

However, the tax revenue from this sector has not risen commensurately its growth.

Multiple tricks to avoid taxes

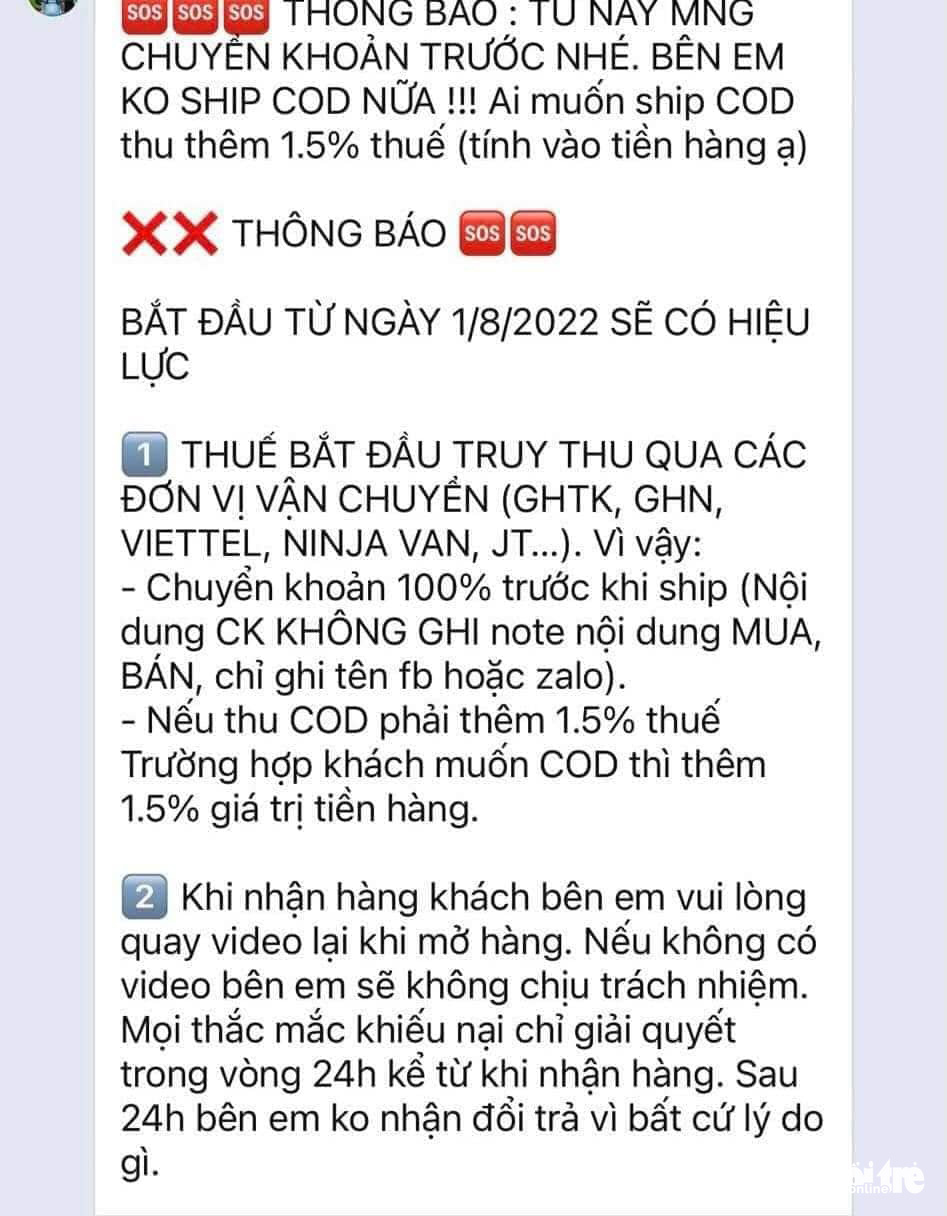

Minh Thu, living in Thu Duc City, a district-level city in Ho Chi Minh City, said after ordering a pair of shoes from an online trader on Facebook, she was surprised as the trader announced that from August 1, customers must make payments in advance and the trader will not offer the cash-on-delivery (COD) service as earlier.

Money transfer descriptions must not include the words 'buy' or 'sell,' but Facebook or Zalo accounts.

“The trader explained that was a way to cope with tax agencies because from August 1, the taxman will collect taxes from online traders through delivery service providers, such as Giao hang tiet kiem, Giao hang nhanh, Ninjavan, and Vietnam Post," Thu said.

“Therefore, the trader must change her trading methods.

"If customers still want to pay for goods at the time of delivery, the trader will collect taxes equal to 1.5 percent of the price."

|

|

| Many online vendors on social networks and e-commerce platforms have sought ways to avoid paying taxes or pass the buck to buyers. Photo: Quang Dinh / Tuoi Tre |

Online traders shift the blame to customers when they ask those using the COD service to pay taxes.

After tax agencies started reviewing transactions through delivery firms and banks, online vendors, besides asking customers to make payments for goods in advance, hide their bank account numbers on their Facebook instead of pinning them to the top of their pages’ timeline.

They are afraid that tax bodies will review their bank accounts and revenue.

Furthermore, instead of trading on their personal Facebook accounts or public pages, many vendors have established private groups to dodge the taxman's attention.

These groups, including tens of thousands to hundreds of thousands of members, have mushroomed and operated actively.

T. in Hanoi said she had a store and sold products through Facebook groups and e-commerce platforms.

Each month, she can secure 200-300 orders, earning a stable income.

Many vendors have sold products through live streams, even from the U.S., and secured dozens of orders.

Despite their high revenue, they still find tax payments unfamiliar.

L.T.H., residing in Cau Giay District, Hanoi, said her monthly income had increased thanks to online trading, especially over the two years of the COVID-19 pandemic.

However, the revenue increase is due to a goods price hike of 5-7 percent per year.

This year alone, many products have seen their prices surging 20 percent over last year.

“I think that the taxable income threshold of VND100 million [$4,275] for online vendors is unreasonable," H. explained the reason why she has yet to declare and pay taxes.

"The revenue increase does not result from me doing business well or securing many orders.

“Phone and delivery costs are taken into account before calculating taxes, so my profit has reduced despite a rise in revenue."

The owner of a store of household appliances and consumer goods on Nui Truc Street in Hanoi said she stopped leasing the store three years ago and now sells products on Facebook and e-commerce platforms only.

Upon the announcement about the tax collection, vendors began to tell each other ways to avoid taxes, including opening many accounts at several banks, and even temporarily using relatives’ accounts.

She also sends goods through two to three delivery firms and in her husband’s and daughter’s names.

Tax obligations in doing business

Dang Ngoc Minh, deputy head of the General Department of Taxation, told Tuoi Tre (Youth) newspaper that Vietnam has 139 companies operating e-commerce platforms, including 41 platforms offering products and 98 providing services, and three partners of foreign companies.

These partners can represent foreign firms to make payments to individuals and organizations conducting transactions with the foreign firms.

|

|

| From August 1, 2022, many online traders ask their customers not to include the words 'buy' or 'sell' in the money transfer descriptions to avoid paying taxes. |

There are some 3.5 million daily visits to e-commerce platforms.

However, the ballooning of e-commerce and cross-border digital services has raised many issues, especially difficulties in tax management.

To deal with the tax evasion of online vendors, tax agencies will continue awareness campaigns and urge them to declare and pay taxes in line with the law.

Moreover, the taxman will enhance inspections of e-commerce platforms, focusing on foreign suppliers without headquarters in Vietnam and some owners of e-commerce platforms.

In reality, the General Department of Taxation has sent statements to the State Bank of Vietnam’s Banking Supervision Agency and the Ministry of Public Security’s Investigation Police Department for Corruption, Smuggling and Economic Crimes, seeking their support in the management of online traders’ tax payment.

Additionally, the general department has proposed asking operators of e-commerce platforms to declare and pay the value added tax (VAT) on behalf of vendors.

To employ this solution, the VAT, personal income tax and tax administration laws, and documents guiding the enforcement of these laws should be amended.

According to Nguyen Viet Anh, senior public sector specialist at World Bank Vietnam, it is required to determine the role of digital platforms in traders’ declaration and payment of the VAT.

He said “owners of e-commerce platforms have to fulfill the obligation of collecting and paying the VAT for products sold on their platforms.”

Meanwhile, online vendors proposed doubling the revenue threshold subject to taxes to at least VND200 million ($8,550).

“If so, sellers can take the initiative in tax declaration and payment. The VND100 million level which has been applied for many years is no longer appropriate and has put traders at a disadvantage,” said Tam, an online seller on e-commerce platforms.

Strengthening inspections to prevent tax evasion

Pursuant to the Ministry of Finance’s Circular 40 coming into force on August 1, 2021, individuals and organizations that are owners of e-commerce platforms must provide information about individuals doing business on their sites, such as their full name, ID/passport number, tax identification number, address, email address, phone number, types of goods and services, revenue, bank account, and other details as requested by tax agencies.

After the circular took effect, the General Department of Taxation has directed local tax offices to enhance inspections of tax evasion in the e-commerce sector, said a leader of the taxman.

Local tax offices must regularly review, classify, monitor, and get updates on information about individual traders and companies doing business on e-commerce platforms and earning incomes from e-commerce activities, such as enterprises generating incomes through Google, Facebook, Apple, and Amazon.

Moreover, enterprises selling goods online, those offering online hotel room booking services (such as Booking.com and Agoda), and enterprises operating e-commerce platforms (such as Sendo, Lazada, and Shoppe) should also be reviewed.

Starting from delivery firms, ecommerce platforms

A leader of the Ho Chi Minh City Tax Department told Tuoi Tre that online business activities have developed quickly but most traders fail to declare and pay taxes.

These traders can easily evade taxes because most buyers on Facebook and e-commerce platforms do not require invoices.

|

|

| Tax agencies have been enhancing the collection of taxes from traders on e-commerce platforms as the tax revenue has not been corresponding to the sector’s huge revenue. Photo: Q.D. / Tuoi Tre |

In addition, traders receive payments through COD services, e-wallets, or bank accounts which are not registered at tax agencies.

Individuals and organizations trading on e-commerce platforms think that tax authorities will not find their revenue, so they do not declare and pay their taxes for many years.

However, under Government Decree 52/2013, traders on e-commerce platforms have to fulfill their tax obligations, while e-commerce platform operators must support the state management agencies to investigate illegal business activities on their sites.

Therefore, the Ho Chi Minh City Tax Department wrote to the operators of Lazada, Shopee, and Tiki, requiring them to ask individuals and organizations selling goods there to issue invoices.

“The platform operators must provide the list of traders failing to issue invoices every quarter, no later than the 30th day of the following quarter," he said.

“However, only one e-commerce platform operator has provided the list which is not sufficient."

In addition to e-commerce platforms, the Ho Chi Minh City Tax Department asked providers of logistics and delivery services which collect money from buyers on behalf of online sellers to report the volume and collected amount to the department.

Payment intermediaries were also asked to provide data about money transferred by buyers to online traders.

However, many units have cited multiple reasons to avoid satisfying the requirement.

They reason that they do not know the regulations, or their parent companies save data in Vietnam for only six months.

Like us on Facebook or follow us on Twitter to get the latest news about Vietnam!