MUMBAI -- Japan’s journey back to normality has just taken an unwelcome turn. The world’s third-largest economy in U.S. dollar terms ceded the title to Germany on Thursday after unexpectedly slipping, opens new tab into a technical recession. More unnerving is a slew of weak data making it harder for the Bank of Japan to justify hiking rates and officially ending its era of ultra-easy monetary policy.

The timing is awkward. The country’s GDP contracted at an annualised rate of 0.4% in the last three months of 2023 due to sluggish domestic demand and falling public investment. There were a few bright spots but they didn’t outshine the bleak picture: exports were resilient, defying a soft global economy, but those were propped up by the weak yen.

The unexpected shrinking landed days after the International Monetary Fund’s First Deputy Managing Director Gita Gopinath confidently declared Japan’s economy was starting to grow at its full potential and urged the BOJ to get a move on. That call suddenly looks premature.

The GDP weakness could prompt the central bank to wait before tweaking its policies. Governor Kazuo Ueda was widely expected to remove “yield curve control” and end a long period of negative interest rates in upcoming central bank meetings in March and April. Under the yield curve control policy, the BOJ pilots yields on 10-year government bonds to around 1%. These actions would signal an official victory in the decades-long fight to reflate the economy.

|

|

| Graphics: Reuters |

True, the economy doesn’t need to grow at full potential to determine whether inflation is sustainably hitting the central bank’s all-important 2% target. Prices are the primary factor, but these are slipping in places too. Core inflation, which excludes fresh food but includes fuel, in Tokyo rose 1.6% in January from a year earlier, its slowest rate in nearly two years.

All eyes will be on Japan Inc to divine the outcome of annual wage negotiations. Company CEOs are sitting on piles of cash but may not want to boost wages much if price increases and economic growth are not sustainably forthcoming.

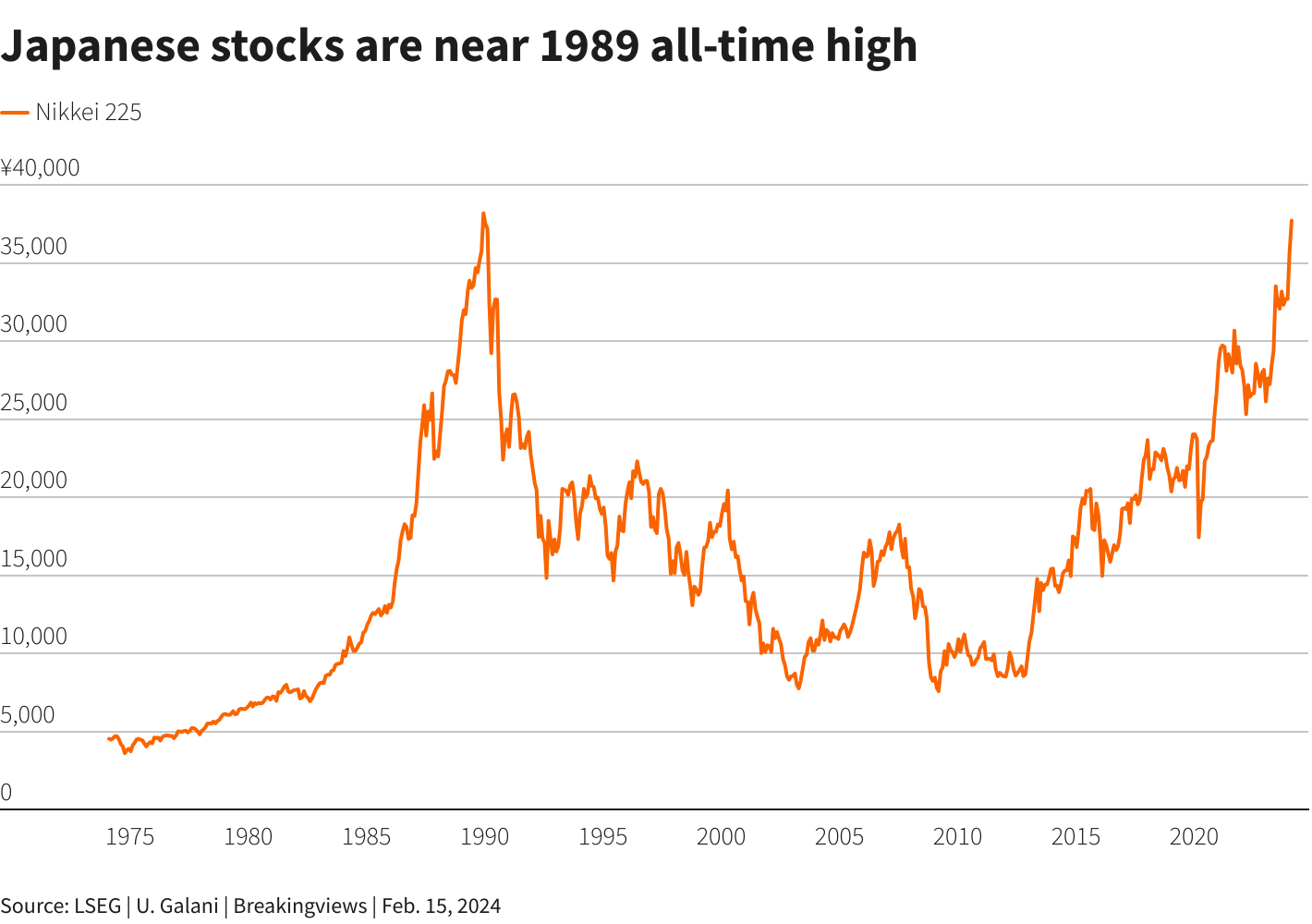

The yen is also reflecting markets’ uncertainty over the direction of interest rates. Instead of rallying against the U.S. dollar on the back of the BOJ’s expected rate rises and expected cuts by the U.S. Federal Reserve, the currency has been weakening this year. Meanwhile stocks are acting out. They generally fall when interest rates rise but the Nikkei 225, a key benchmark, is at a 34-year high and within a whisker of the record reached in 1989 before the country’s asset bubble burst.

Japan pioneered new monetary policy tools in its long and tortuous journey to boost domestic demand and inflation. It is almost at its destination but the final stretch back to normalcy is looking increasingly complicated.

Japan’s gross domestic product fell at an annualised rate of 0.4% between October and December 2023, following a 3.3% slump in the previous quarter, government data released on Feb. 15 showed. The market was forecasting a 1.4% increase, Reuters reported.