MADRID -- Jose Maria Cofreces is the owner of a guesthouse in northwestern Galicia, one of Spain's most picturesque regions and a major tourist draw.

It is also one of the windiest parts of the country, and that has made it a magnet for developers of giant wind turbines that can stand higher than 50-story tower blocks.

Cofreces is among those at the vanguard of opposition in Galicia. Echoing the tactics of rural communities across Europe, the protesters have used the courts to block plans they say encroach on their way of life and the environment.

"Part of what we sell here is the landscape," he said. "Wind farms mean having the mountains drilled, filled with holes and lots of concrete."

The wind farm that would loom over his property would comprise 12 170-meter (558 ft) tall turbines, if the developers' hopes materialize.

It is one of 72 - with an overall capacity of around 2 gigawatts (GW), based on more than 2 billion euros ($2.04 billion) in investments, that were approved by the regional government. They were then halted by the highest regional court, mostly in the last year, after locals and environmental groups filed hundreds of lawsuits.

|

|

| Wind turbines operate at a wind farm in Dumbria, near Finisterre, Galicia, Spain, December 12, 2024. Photo: Reuters |

European governments are under pressure to support the European Union's ambitious green energy targets, including a significant expansion of wind energy capacity.

In Europe, Spain is behind only Germany for wind power generation capacity, but its plans to double the amount by the end of the decade have been slowed by the local opposition, as well as licensing bottlenecks.

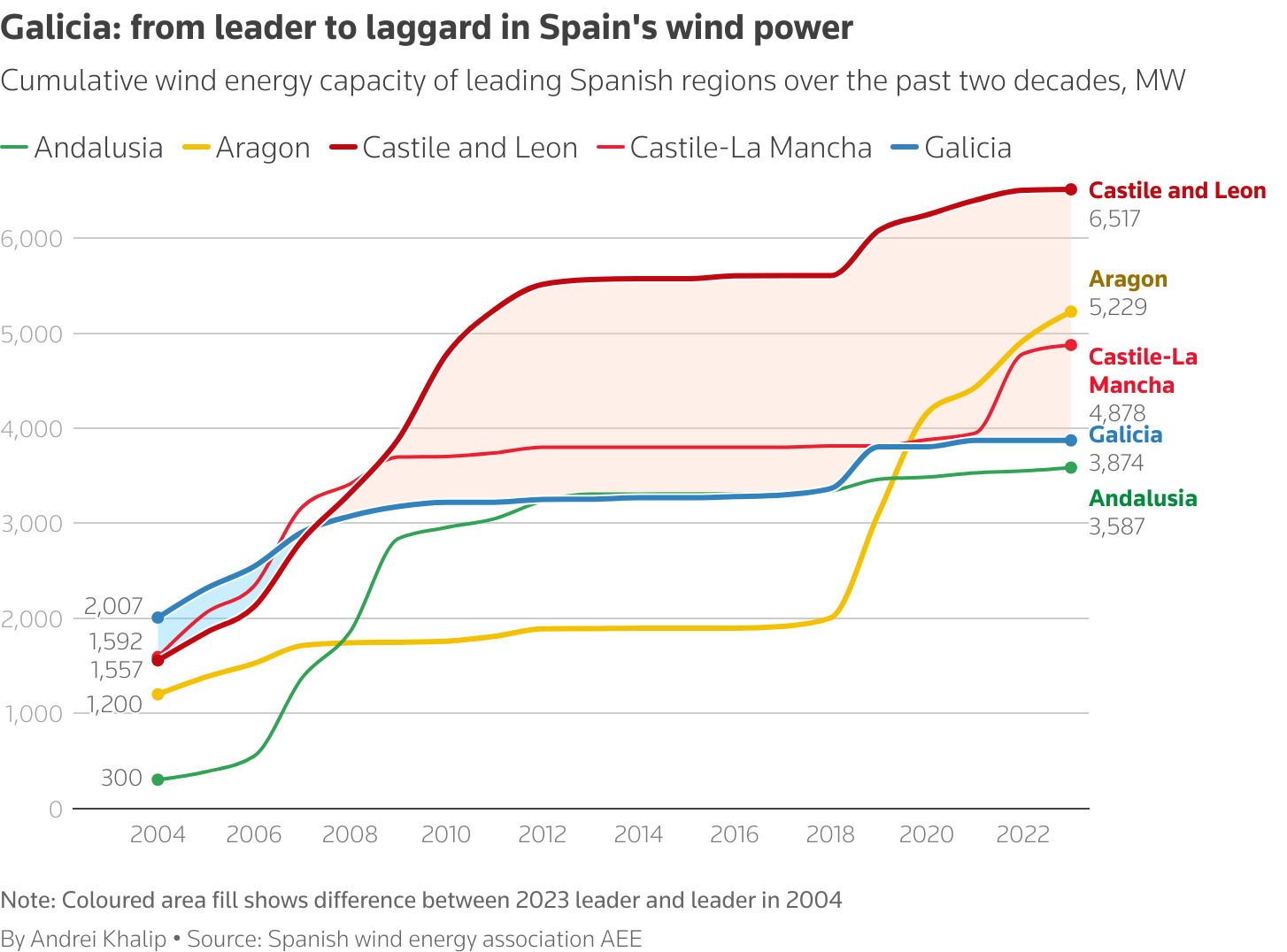

"In Galicia, there's a complete paralysis," Juan Virgilio Marquez, general director of Spanish wind group AEE, said.

The region did not install a single megawatt (MW) of new wind capacity in 2022 and 2023 and just 69 MW between 2020 and 2023, the latest available data from AEE show.

Endangering heritage

Apart from pitching protesters against governments, the opposition is also at odds with many residents, research has found.

Three-quarters of Galicians want more wind energy, according to a September poll by Galician market research firm Sondaxe.

|

|

| Wind turbines operate at a wind farm in Dumbria, near Finisterre, Galicia, Spain, December 12, 2024. Photo: Reuters |

On the other side of the argument, protesters across Europe have coalesced into organized movements, like those in Galicia, where they have launched sophisticated legal challenges, often financed by crowdfunding campaigns, analysts and industry insiders said.

Christoph Zipf of industry association WindEurope said the groups know the weak links in the permitting process and target them, then share successful experiences with each other.

That leads "to higher chances for these projects to be stopped," he said.

In East German regional elections in September, the far-right AfD party made opposition to renewable energy projects a focus of its successful campaign.

On the Italian island of Sardinia, local opposition to wind led the authorities to pass a law in September that renewable developers say rendered more than 90 percent of the island's territory off limits to their projects.

Back to Galicia, 243 lawsuits have targeted 90 of the 137 planned projects with permits, including the 72 stalled so far, according to data from the regional government. Overall, lawsuits and administrative appeals affect 98 wind projects.

The copycat legal challenges say the Galician regional government - that awards permits for projects under 50 MW - did not give sufficient weight to environmental risks and did not adequately ensure public participation in the process.

In 72 cases, Galicia's highest court ordered precautionary suspensions on procedural or environmental grounds. The regional government has appealed to Spain's Supreme Court.

The Galician court also asked the European Court of Justice in June to rule on whether Galician and Spanish laws comply with EU access to information rules in the permitting process.

Until a ruling, whose timing is uncertain, developers will be wary of moving forward even with projects that are not suspended, Marquez said.

Belen Rodriguez of Galician activist group Adega, which has successfully blocked some 20 projects, said the opposition was the product of "a situation that overwhelmed us".

"We had no choice but to go to court," she said, adding that their earlier attempts to make representations in the administrative process were overlooked.

|

|

| Wind turbines are seen in front of the Atlantic Ocean at a wind farm in the Serra da Capelada, near Ferrol, Galicia, Spain, September 13, 2024. Photo: Reuters |

'Critical uncertainty'

Renewable developers with billions of euros in investments at stake are under pressure, as intensive energy users, such as U.S. aluminium giant Alcoa, seek huge volumes of clean energy via long-term supply contracts to ensure competitive and stable prices.

Some of the wind parks in legal limbo should have started operating last year, supplying energy to Alcoa's complex in the region that employs nearly a 1,000 people.

Alvaro Dorado Baselga, vice president for energy at Alcoa, told Reuters in an emailed statement that competitive and stable power prices are essential for the business and described the delays as a source of "critical uncertainty" threatening its viability.

A Deloitte report for the local wind lobby published in October 2023 found that 32 industrial projects planned for Galicia would require over 6 billion euros' worth of investments and create more than 7,000 direct jobs a year largely rely on cheap renewable energy supply.

|

|

| The chart shows top-performing Spanish regions by wind power capacity between 2004 and 2023 |

Paula Uria, the regional government's director general for renewable energy, said the 137 parks with permits would add 3 GW of wind capacity.

AEE, the Spanish wind group, estimates that the addition of such capacity would generate around 4,800 jobs over five years.

The situation in the region is "difficult to understand," Uria said, as the regional court is blocking projects that, under the same rules, have moved forward elsewhere in Spain.

From this year, she said developers will be able to request a new, faster approval procedure for parks hit by lawsuits.

The regional parliament also approved in December rules it estimates could lead to the replacement of 3,000 ageing wind turbines with as few as 400 modern ones, reducing the impact on the landscape, although it has also exasperated the industry.

At an event in Galicia in November, Joaquin Garcia-Boto, Development Director at EDP Spain, summed up the mood: hindering renewables in Galicia, he said, may be "killing the goose that lays the golden eggs".

($1 = 0.9794 euros)

![[2/4]Wind turbines operate at a wind farm in Dumbria, near Finisterre, Galicia, Spain, December 12, 2024. Photo: Reuters](https://static.tuoitrenews.vn/ttnew/r/2025/01/14/qssldk5mjjn63bdneei5x54pjm-1736843093.jpg)

![[3/4]Wind turbines operate at a wind farm in Dumbria, near Finisterre, Galicia, Spain, December 12, 2024. Photo: Reuters](https://static.tuoitrenews.vn/ttnew/r/2025/01/14/xq2cjnn2tfp23nhldnzpn6t3na-1736843093.jpg)

![[4/4]Wind turbines are seen in front of the Atlantic Ocean at a wind farm in the Serra da Capelada, near Ferrol, Galicia, Spain, September 13, 2024. Photo: Reuters](https://static.tuoitrenews.vn/ttnew/r/2025/01/14/34e65wlrbnl5xhfgewlkjt5zha-1736843093.jpg)