WASHINGTON/OTTAWA -- President Donald Trump reversed course on Tuesday afternoon on a pledge to double tariffs on steel and aluminum from Canada to 50%, just hours after announcing the higher tariffs, in rapid-fire moves that scrambled financial markets. The switch came after a Canadian official also backed off his own plans for a 25% surcharge on electricity.

Trump's latest salvo, which whipsawed financial markets and rekindled fears of inflation, followed Ontario Premier Doug Ford's announcement that he would place on the electricity Canada's most populous province supplies to more than 1 million U.S. homes unless Trump dropped all of his tariff threats against Canada's exports into the U.S.

Faced with Trump's 50% tariff threat, Ford agreed to suspend the surcharge and meet with U.S. Commerce Secretary Howard Lutnick in Washington on Thursday.

The White House then announced that only the previously planned 25% tariffs on steel and aluminum products from the United States' northern neighbor and all other countries would take effect on Wednesday - with no exceptions or exemptions.

"President Trump has once again used the leverage of the American economy, which is the best and biggest in the world, to deliver a win for the American people," White House spokesperson Kush Desai said in a statement. "Pursuant to his previous executive orders, a 25% tariff on steel and aluminum with no exceptions or exemptions will go into effect for Canada and all of our other trading partners at midnight, March 12th.”

The back-and-forth between the U.S. and Canada further unsettled financial markets already battered by Trump's focus on tariffs. After tumbling hard after Trump's initial post on Truth Social, stocks rebounded after Ford said he would suspend the surcharge and Ukraine agreed to a 30-day ceasefire.

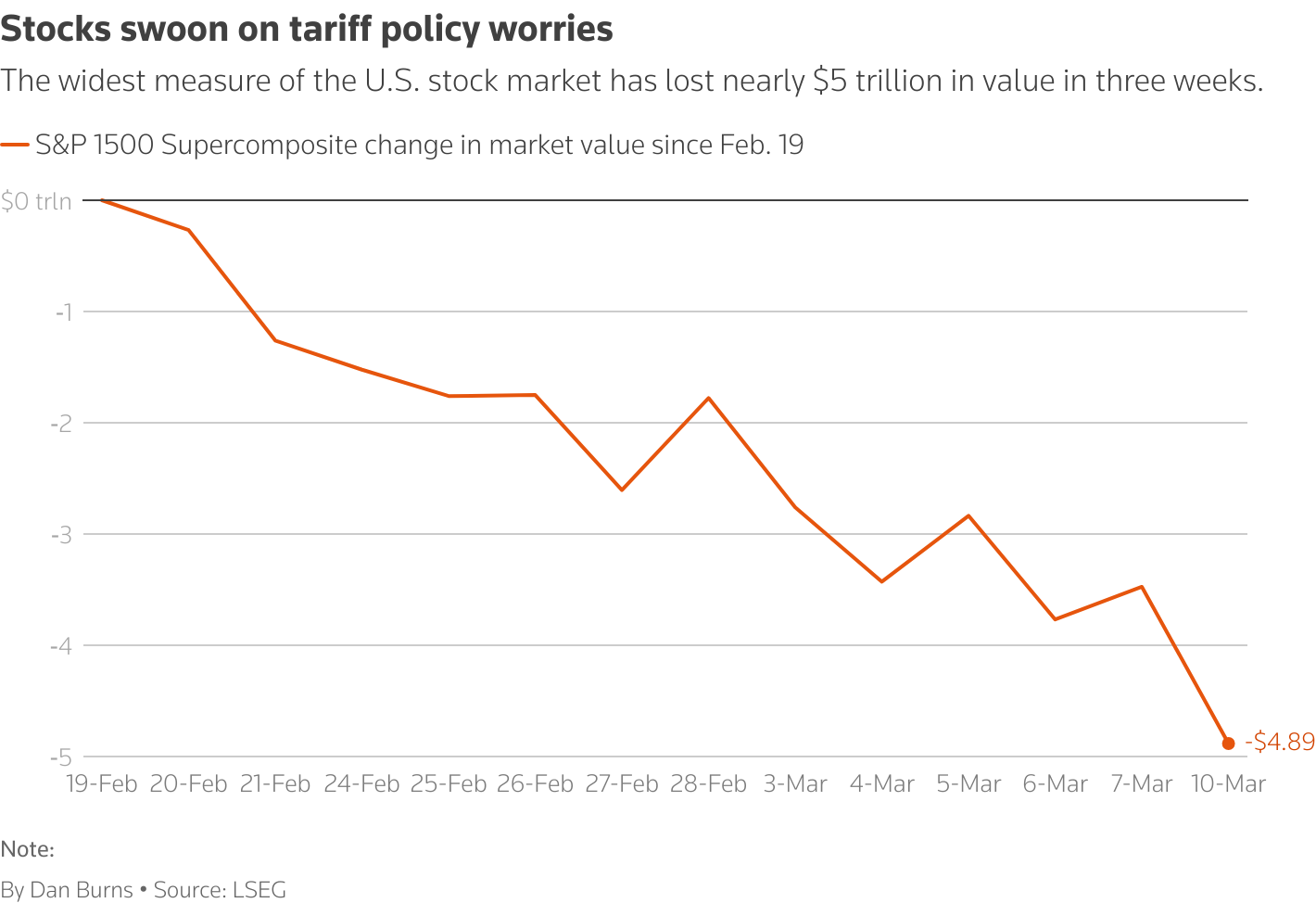

The S&P 500 index dropped as low as 5,528.41 points, briefly marking a 10% fall from its record closing high of 6,144.15 on February 19, which is commonly known as a market correction. U.S. stocks have fallen hard since reaching a record high about a month after Trump took office on January 20, with nearly $5 trillion of market value erased from U.S. indexes.

|

|

| Graphics: Reuters |

Trump triggered the selloff with a morning post on his Truth Social media platform, saying he had instructed Lutnick to put an additional 25% tariff on the metals products from Canada that take effect on Wednesday, on top of the 25% on all imported steel and aluminum products from other countries.

He also criticized Canada for trade protections on dairy and other agricultural products and threatened to "substantially increase" duties on cars coming into the U.S. that are set to take effect on April 2 "if other egregious, long time Tariffs are not likewise dropped by Canada."

The U.S. president shook off the market gyrations, telling reporters that markets would go up and down, but that he had to rebuild the economy.

Trump, heartened by Ontario's move, said the tariff rates could rise further, building pressure on countries to move manufacturing into the United States.

"The higher it goes, the more likely it is they're going to build ... The biggest win is not the tariffs. That's a big win. It's a lot of money. But the biggest win is they move into our country and produce jobs," he said, insisting the tariffs would "be throwing off a lot of money to this country."

The escalation of the trade war occurred as Prime Minister Justin Trudeau prepared to hand over power this week to his successor Mark Carney, who won the leadership race of the ruling Liberals last weekend. On Monday, Carney said he could not speak with Trump until he was sworn in as prime minister.

White House press secretary Karoline Leavitt told reporters that Ford's initial comments were "egregious and insulting" and said Canada would be "very wise not to shut off electricity for the American people." Trump was determined to ensure the U.S. relied on its own domestic electricity, she said.

|

|

| Raw steel coils are seen on the floor of the galvanizing line at ArcelorMittal Dofasco in Hamilton, Ontario, Canada February 14, 2025. Photo: Reuters |

Another Canadian province, Alberta, gave U.S. officials options to de-escalate the trade dispute, its energy minister told reporters at the CERAWeek energy conference in Houston.

Trump later met with about 100 chief executives of U.S. firms amid evidence that his trade policies could hurt the U.S. economy, threatening to dash a "soft landing" that until recently appeared as the base case and reignite inflation.

Before the gathering, airlines, department stores and other businesses warned that his fast-shifting trade policies are starting to have a chilling effect, with consumers pulling back on purchases of everything from basic goods to travel.

Confidence takes a hit

Leavitt sparred with an AP reporter over the tariffs during a regular briefing after he questioned why Trump was now backing tax hikes in the form of tariffs after pushing for tax cuts.

"Ultimately, when we have fair and balanced trade, which the American people have not seen in decades ... revenues will stay here, wages will go up and our country will be made wealthy again," she said. "And I think it's insulting that you are trying to test my knowledge of economics, and the decisions that this president has made. I now regret giving a question to the Associated Press."

|

|

| Coils of rolled steel sit in an industrial yard with transmission towers and smokestacks in the background at dusk in Hamilton, Ontario, Canada, January 27, 2025. Photo: Reuters |

Investors are bracing for a further round of tariffs on autos as well as tit-for-tat reciprocal tariffs in early April. Canada and China have retaliated with their own tariffs on U.S. exports, while Mexico stopped short of retaliation after Trump delayed his planned levies on the southern U.S. neighbor.

"This is what a trade war looks like," said Josh Lipsky, senior director of the Atlantic Council's GeoEconomics Center. "Tit-for-tat escalation which can quickly spiral to both sides' economic detriment."

The metals tariffs will apply to millions of tons of steel and aluminum imports from Canada, Brazil, Mexico, South Korea and other countries that had been entering the U.S. on a duty-free basis under carve-outs. Trump has vowed that the tariffs will be applied "without exceptions or exemptions" in a move he hopes will aid the struggling U.S. industries.

Trump's promise to double the metals levies on Canada sent some aluminum prices soaring. Price premiums for aluminum on the U.S. physical market climbed to a record high above $990 a metric ton on Tuesday.

Trump's hyper-focus on tariffs since taking office in January has rattled investor, consumer and business confidence in ways that economists increasingly worry could cause a recession. A small business survey on Tuesday showed sentiment weakening for a third straight month, fully eroding a confidence boost following Trump's November 5 election victory, and a survey of households by the New York Federal Reserve on Monday showed consumers growing more pessimistic about their finances, inflation and the job market.