A draft resolution seeking a higher threshold for personal income tax (PIT) is being examined by Vietnam’s legislators to help its citizens cushion the impacts of the novel coronavirus disease (COVID-19) pandemic.

After the lawmaking National Assembly’ Finance and Budget Committee finishes the examination, Standing Committee of the legislature is slated to give their opinions on the draft on Saturday.

The document proposed a new PIT threshold of VND11 million (US$472) a month, which is VND2 million ($86) higher than the current level, for taxpayers, and VND4.4 million ($189), compared to the effective threshold of VND3.6 million ($154), for dependents.

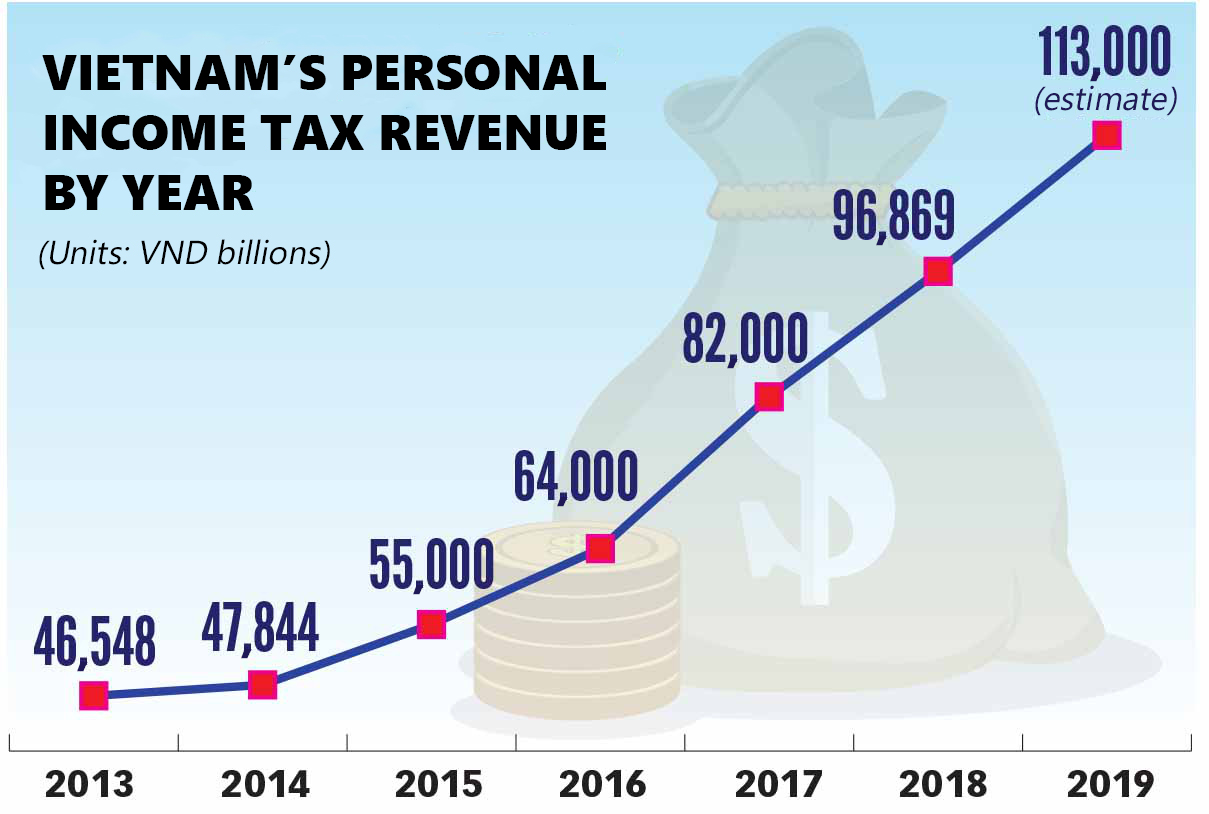

The increase of the news thresholds is calculated based on the 23.2-percent growth of the consumer price index (CPI) between July 1, 2013, when the revised Law on Personal Income Tax came into effect, and the end of December 2019.

The Ministry of Finance estimates that the yearly state budget revenue will fall by VND10.3 trillion ($441.6 million) once the draft resolution is passed as taxpayers enjoy reduced payable tax.

For instance, a taxpayer with a monthly income of VND15 million ($643) and one dependent will be tax-exempted, instead of paying VND120,000 ($5.15) a month as currently.

Likewise, a taxpayer with a monthly income of VND20 million ($858) and two dependents will have to pay only VND10,000 ($0.43) a month, instead of VND190,000 ($8.15) each month as currently.

|

| People perform tax finalization procedures at the Ho Chi Minh City Tax Department in this undated photo. Photo: Quang Dinh / Tuoi Tre |

In another draft resolution to resolve difficulties faced by wage earners at companies affected by COVID-19, the Ministry of Investment and Planning proposed the government delay PIT payment until the end of the year.

However, experts have expected that PIT will be scraped for at least six months.

Tran Minh Hiep, a lecturer of commercial law at the Ho Chi Minh City University of Law, said that Vietnam had once exempted PIT for the first six months of 2009 following the financial crisis of 2007-08.

“I think that in order to create conditions for workers to regain life balance [post-COVID-19], there should be a stipulation that they can enjoy PIT exemption for at least six months in 2020,” Hiep said.

Elaborating on Hiep’s opinion, Nguyen Cong Hung, chairman of the Hanoi Taxi Association, suggested a PIT exemption until the end of the year.

As many as 1,523 enterprises in Ho Chi Minh City were dissolved in the first four months of this year, an increase of 54.82 percent from the same period in 2019, according to the municipal Department of Tax.

Revenues from corporate income tax and value-added tax decreased by 11.08 percent and 6.27 percent, respectively, in the first four months of 2020 compared to the same period last year.

Meanwhile, personal income tax revenue climbed by 8.96 percent over the same period.

|

Like us on Facebook or follow us on Twitter to get the latest news about Vietnam!