Industry insiders and experts are calling on the government to rewrite local tax rules to force major Internet companies to pay tax on profits they make from the Vietnamese market.

As more and more Vietnamese holidaymakers get used to booking their trips online, hotel booking platforms such as Agoda and Booking.com earn hundreds of millions of U.S. dollars per year in the country.

Making it a win-win for these international companies is the fact that they do not have to pay taxes, with the responsibility shouldered by their Vietnamese partners due to loopholes in current tax rules, according to pundits.

Understanding ‘foreign contractor tax’

It’s essential to understand ‘foreign contractor tax’ in Vietnam before digging deeper into the issue.

Foreign contractor tax consists of value-added and corporate income taxes, with rates set by tax authorities depending on the type of services.

The current rate is 5 percent for both value-added and corporate income tax for foreign companies that generate income via services offered in Vietnam.

When a Vietnamese entity contracts a foreign party that does not have a licensed presence in Vietnam, the payment the contracting party makes to the contractor is subject to foreign contractor tax.

As the contractor does not have a legal presence in Vietnam, the contracting party has to pay the tax on its behalf.

The Vietnamese entity can offset this obligation by deducting the foreign contractor tax when calculating the payment it has to make to the contactor.

For example, if a Vietnamese company has to pay a foreign contractor of $1,000, the foreign contractor tax will be $100.

According to the law, the Vietnamese company must negotiate the payment at $900, setting aside the $100 to pay the local taxman.

However, local hotels have claimed that it is not so easy to do so when working with companies like Booking.com

|

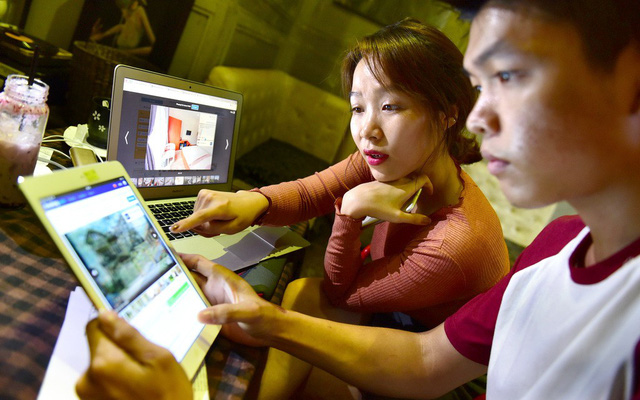

| Two tourists look up information on online booking platforms prior to taking their trip to Da Nang. Photo: Tuoi Tre |

Local firms take the burden

Booking.com, which is based in the Netherlands, collects a 20 percent commission from Vietnamese hotel owners on every room booked through its platform, and this income is subject to foreign contractor tax.

However, Pham Ha, CEO of Luxury Travel, said Booking.com will not accept the tax deduction by its Vietnamese partners, saying it should enjoy a tax exemption thanks to a double taxation avoidance agreement between the Netherlands and Vietnam.

The online platform will regularly threaten to cease their partnership if Vietnamese companies insist on the deduction, Ha said.

“Many local companies have been forced to use money from their own pocket to pay the taxes, fearing that the contract termination with Booking.com will affect their sales,” the insider said.

“This is a double whammy for Vietnamese companies as they already have to pay their own corporate income tax. “

Pham Xuan Anh, chairman of Viet Excursions Co., confirmed the phenomenon that Vietnamese companies have no choice but to pay the tax for Booking.com, as the online service insists they receive a 20 percent commission without tax deduction.

“Some Vietnamese companies have to accept smaller profits as they have no other choice,” Anh said.

Tax losses

Le Dac Lam, CEO of the hotel booking website Vntrip.vn, said revenue from the Vietnamese hotel sector is expected to reach US$21 billion by 2020, with 50 percent, or $10.5 billion, coming from online booking platforms.

Supposing that domestic tourists contribute 50 percent of the revenue, online booking companies will rake in approximately $1.25 billion, which leaves a significant amount of tax Vietnam is unable to collect.

Lawyer Tran Xoa, principal at the Minh Dang Quang law firm, said many Internet companies have taken advantage of loopholes in current tax rules, including the double taxation avoidance agreement, in order to avoid paying foreign contractor taxes on incomes generated in Vietnam.

According to the law, a foreign company is still recognized as not having a permanent presence in Vietnam even when it has a representative office or a subsidiary in the country.

Booking.com or Uber have said they only work with local hotels and drivers rather than having a presence in the country, so they should be able to enjoy the tax exemption.

Like us on Facebook or follow us on Twitter to get the latest news about Vietnam!