Ho Chi Minh City-based Nguyen Kim, one of Vietnam’s leading electronics chains, has been subject to VND148.33 billion (US$6.42 million) worth of fines and tax arrears for reducing the amount of personal income tax its employees had to pay.

The whopping sum includes VND104.74 billion ($4.5 million) in personal income tax arrears, a VND19.41 billion ($834,630) fine for administrative violations, and another VND24.18 billion ($1.04 million) penalty for late tax payment, according to the municipal tax department.

The city’s taxman launched an inspection into Nguyen Kim on May 28 and announced the results on June 29.

According to a source close to Tuoi Tre (Youth) newspaper, Nguyen Kim dodged the payment of personal income tax for its executives and employees by turning their allowances and bonuses into overtime pay.

Under the Vietnamese personal income tax law, the disparity between overtime pay and regular pay is considered non-taxable income.

By applying this trick, Nguyen Kim could significantly reduce the amount of tax for its employees, especially the highly-paid ones.

For example, while a top leader of Nguyen Kim is actually paid VND300 million ($12,900), including all kinds of allowances and bonuses, on a monthly basis, the company would just calculate his personal income tax on a basic salary of VND30 million ($1,290).

The remaining VND270 million ($11,610) was counted as overtime pay, which generated much lower taxable income.

|

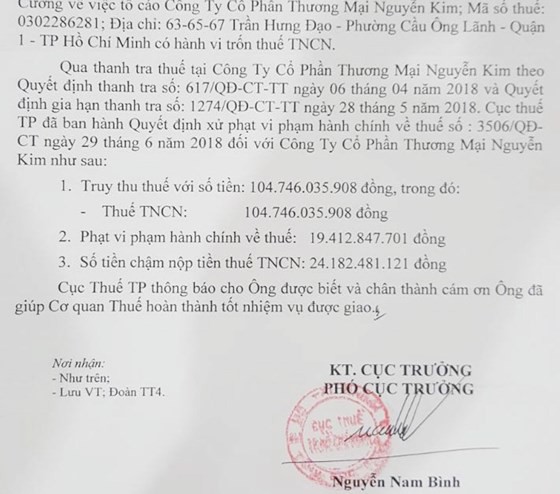

| A photo captures the decision to fine Nguyen Kim by the Ho Chi Minh City tax department. |

The quarterly bonuses of thousands of Nguyen Kim employees were also converted into overtime pay by the company in the same tax dodge trickery.

Nguyen Kim has a large number of employees, including nine general directors and deputy general directors, and 36 store directors.

Simply ‘false declaration’

The tax inspection into Nguyen Kim, initiated following some denunciations of the company’s alleged tax evasion, looked into tax payment activities of the company in “quite a long period,” Le Duy Minh, deputy head of the Ho Chi Minh City tax department, said without elaboration.

Minh asserted that Nguyen Kim’s violation was merely to falsely declare personal income taxes for its employees, while all their incomes are legitimately recorded in the accounting books.

“The electronics store chain was therefore not fined for tax evasion,” he said.

Nguyen Kim now has ten days to clear the hefty VND148 billion fines and back taxes, Minh added.

The company has called on the General Department of Taxation and the Ministry of Finance to look into the case.

Nguyen Kim is headquartered on Tran Hung Dao Street, District 1, Ho Chi Minh City.

In 2015, the electronic appliances chain sold 49 percent of its stakes to the Thai conglomerate Central Group.

|

| Customers shop at a Nguyen Kim store on Tran Hung Dao Street in Ho Chi Minh City’s District 1. Photo: Tuoi Tre |

Like us on Facebook or follow us on Twitter to get the latest news about Vietnam!