Vietnam is one of the fastest-growing economies in the world, yet its stock market has been struggling for years, with the benchmark VN-Index hovering around 1,200 points.

Dominic Scriven, chairman of Dragon Capital, Vietnam's largest private asset manager, told Tuoi Tre (Youth) newspaper that the Vietnamese stock market lacks new and interesting products to attract foreign investors.

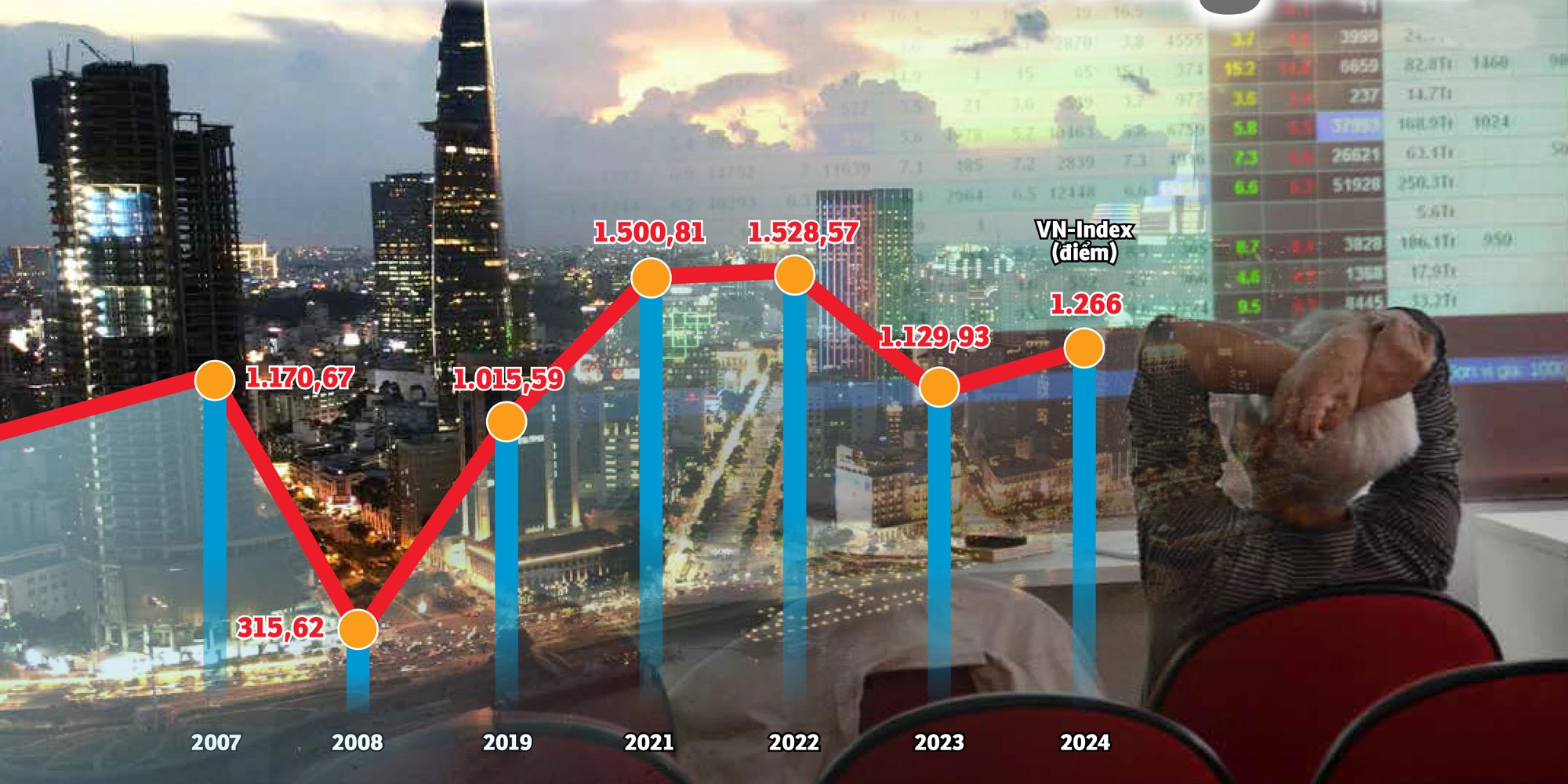

Domestic investors pay attention to the VN-Index, but the index has been stuck at around 1,200 points for nearly two decades.

Nguyen Quang Thuan, chairman of financial information and credit rating service provider Fiingroup, said the VN-Index approached 1,200 points in 2007. However, it has gradually fallen since the 2007-08 global financial crisis.

At the end of 2021, the index hit a new record high to exceed 1,500 points for the first time. However, it plunged after just one year.

At present, the VN-Index is still rooted to the 1,200-point mark despite ongoing economic growth.

Experts suggest that the index has struggled to gain momentum due to significant market volatility, largely driven by individual investors, who account for over 90 percent of market transactions and are often swayed by emotional decision-making.

The sluggish growth of the local stock market is further attributed to delays in market upgrades, as well as a lack of high-quality new listings and innovative financial products.

According to Nguyen Hoang Giang, chairman of DNSE JSC, finance, banking, and real estate investors represent some 60 percent of Vietnam's stock market capitalization, with that number occasionally moving upward to 70-80 percent.

Vu Duy Khanh, director of research at Smart Invest Securities JSC, said the market needs high-quality services and new products to appeal to both local and foreign capital.

Currently, the number of listed enterprises can be counted on one hand, and they have almost no new products for transactions, Khanh said, adding that without product and service quality improvement, foreign capital will never be channeled into the market despite upgrades.

|

|

| Attracting capital, especially from foreign investors, is important to boost the Vietnamese stock market development. Photo: B.Mai / Tuoi Tre |

Huynh Hoang Phuong, an asset management consultant at FIDT, which specializes in asset management and investment consulting, claimed that many large stocks in Vietnam surge to be market leaders but see sharp declines shortly afterward.

The stagnant index is also blamed on the poor performance of large firms, specifically Hoang Anh Gia Lai, FLC, and Novaland, demonstrating the inconsistent quality of listed companies in Vietnam.

Solutions to attract capital

Accordign to Dragon Capital chairman Scriven, new products and market upgrades might help improve the attractiveness of the Vietnamese stock market.

He hoped a new IT system could be employed and the adoption of a central clearing mechanism could be accelerated.

Domestic experts threw their support behind Scriven, saying that upgrading the market is just one aspect of the issue, and that products themselves must be upgraded as well.

Fiingroup chairman Thuan suggested intensifying the reduction of state ownership in certain companies and sectors.

The stagnant privatization and the modest number of listed companies have hindered the market from reaching new milestones.

Thuan also emphasized the need to encourage enterprises listed on the Unlisted Public Company Market (UPCoM) to move to the Hanoi or Ho Chi Minh City bourses and improve their corporate governance and transparency policies.

Phan Dung Khanh, head of investment consulting at Maybank Investment Bank, proposed boosting the development of tech companies.

While AI and semiconductors have attracted significant global investment, the limited availability of stocks from these enterprises has made the Vietnamese stock market less appealing.

Expanding this sector remains a challenge, however, as Vietnam has a relatively small number of companies operating in these fields.

Companies delay listing

In 2017, the local stock market witnessed a big wave of net purchases by foreign investors with a record value of over US$2 billion, eight times the net purchase value in 2016.

That trend continued in 2018 and 2019 due to the simplification of local procedures and increased state divestment from well-performing enterprises such as brewer Sabeco and dairy producer Vinamilk.

A leader of a securities company in Ho Chi Minh City claimed that recent investments in the stock market were motivated by the record low deposit rates and the U.S. Federal Reserve’s signals of monetary policy easing.

|

|

| An employee of SSI Securities Corporation provides advice to a customer in Ho Chi Minh City. Photo: T.T.D. / Tuoi Tre |

But the most important factor was the list of available products.

Meanwhile, listing plans for lender Agribank, telecom companies MobiFone and VNPT, as well as Vietnam National Coal and Mineral Industries Group have shown no progress.

VNPT was scheduled to conduct an initial public offering at the end of 2019, offering 35 percent of its shares to investors, but the plan never came to fruition.

In the middle of this year, the State Capital Investment Corporation announced that it would sell shares in tech giant FPT and Tien Phong Plastic Joint Stock Company.

Many investors pinned high hopes on the information.

Such announcements have been made over the past few years but state capital still remains in many companies.

The securities company leader said many enterprises are hesitant to list on stock exchanges due to an aversion to pressure and responsibility, not to mention red tape related to land use rights and assets attached to land.

According to data from Fiingroup, banking, securities, and real estate are among the most actively traded stocks by individual investors.

Individual investors are highly susceptible to herd mentality and easily influenced by rumors and trends, according to Phuong from FIDT.

He added that Vietnam should focus on diversifying its investor base by establishing new fund management companies and financial foundations.

Equally important is the need to enhance existing financial products.

Fiingroup chairman Thuan emphasized improving these products by streamlining the information disclosure process and tightening oversight of business leaders’ transactions.

|

|

| Foreign investors have repeatedly withdrawn capital from the Vietnamese stock market. Photo: B.Mai / Tuoi Tre |

Market upgrade delays

Foreign investors have net sold nearly VND95 trillion ($3.7 billion) on the Vietnamese stock market since early this year, much higher than the VND22 trillion ($864.2 million) last year.

Bui Van Huy, director of the Ho Chi Minh City branch of DSC Securities JSC, said market upgrading remains a key factor to attract capital into the stock market next year.

FTSE Russell has included Vietnam in the list of markets awaiting an upgrade from a frontier market to a secondary emerging market as it has met seven out of the nine criteria, Huy informed.

The two remaining criteria for market improvement are allowing foreign investors to purchase Vietnamese stocks without pre-funding and addressing failed trade settlements.

The Vietnamese Ministry of Finance recently issued a circular eliminating the pre-funding requirement for foreign investors, which came into effect on November 2.

Experts anticipate that these changes could lead to the local stock market being upgraded by September next year.

New stock trading system KRX to begin operations in 2025

At a recent conference of the Vietnam Stock Exchange to review its 2024 performance and discuss plans for 2025, a leader of the State Securities Commission of Vietnam asked the Ho Chi Minh Stock Exchange (HoSE) and relevant units to launch the new stock trading system KRX next year.

Deputy director of a securities company said delays in the operation of KRX have weakened the confidence of investors.

HoSE inked a deal with the Korea Exchange in 2012 to develop KRX.

Like us on Facebook or follow us on Twitter to get the latest news about Vietnam!