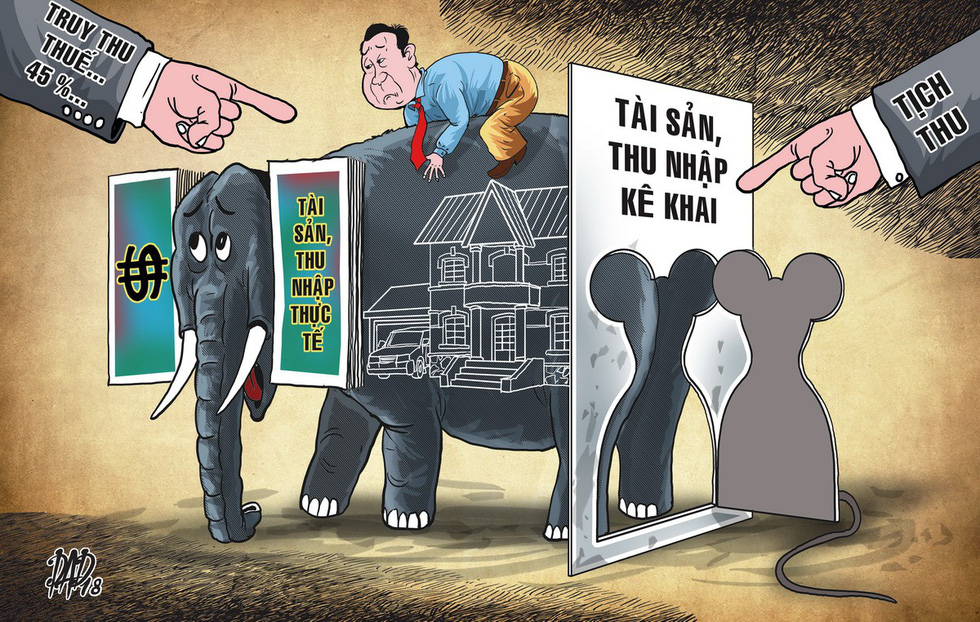

Vietnam is mulling over imposing a personal income tax of 45 percent on suspicious wealth owned by individuals in the latest draft of a revised anti-corruption law.

The draft legislation seeks to slap the tax on individuals if they cannot explain why they own assets worth more than their income and cannot prove they have acquired them legally.

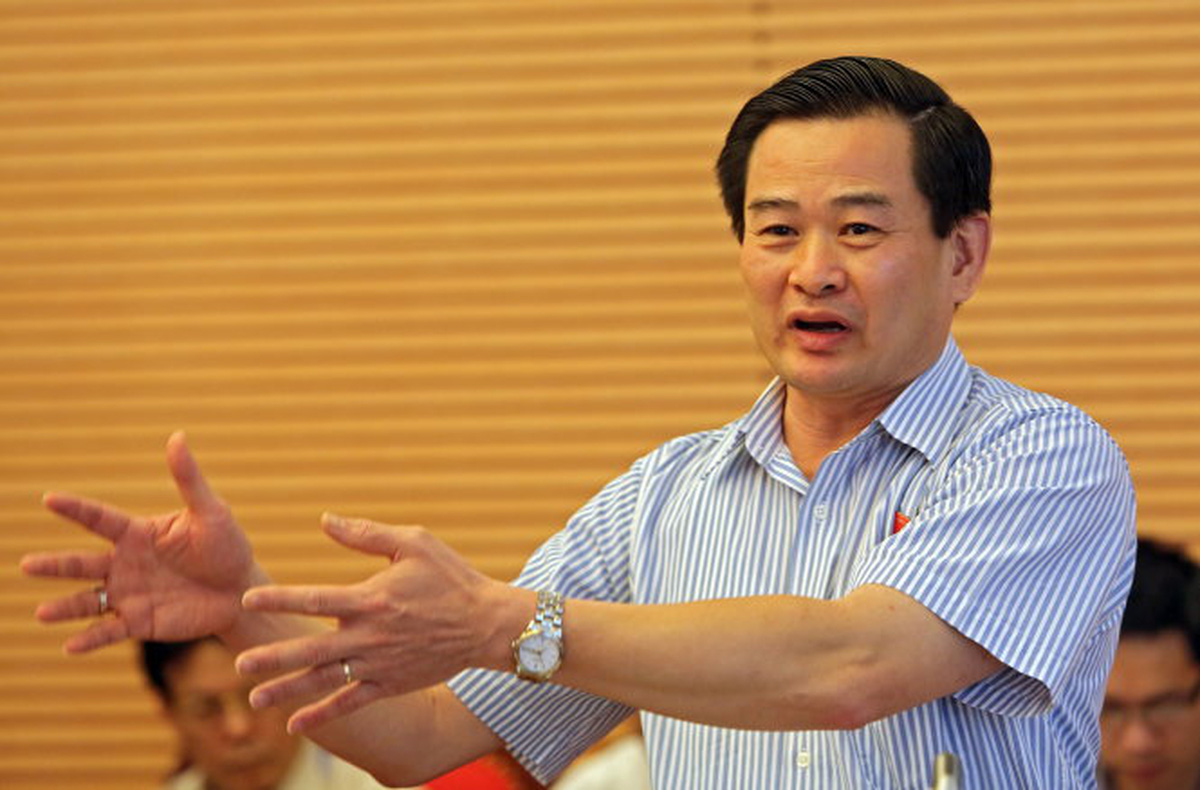

The change to Vietnam’s Law on Corruption Prevention was presented by Inspector-General of the Government Le Minh Khai before a legal committee of the lawmaking National Assembly on Monday.

According to Khai, the tax will be considered personal income tax arrears, based on conclusions from competent authorities that there had been discrepancies in a taxpayer’s declared assets and their real property.

The collection of tax arrears does not entail exemption from criminal liability, as the individual can still face prosecution if their assets are later proven to have been acquired via illegal means, Khai explained.

“Individuals retain their right to file complaints or lawsuits against the tax collection, which will then be handled on a case-by-case basis by relevant courts,” he added.

|

| Inspector-General of the Government Le Minh Khai speaks before a legal committee of the lawmaking National Assembly, March 5, 2018. Photo: Tuoi Tre |

According to Nguyen Manh Cuong, vice-chairman of the National Assembly’s Legal Committee, there is still a grey area in Vietnam’s legal system concerning unusual property that can neither be explained nor proven to have been illicitly acquired.

“Chances are that the property traces its origin to corruptive or illegal activities,” Cuong said.

Deputy Inspector-General of the Government Nguyen Van Thanh said the proposed tax is based on the presumption that the unexplained wealth was legal, but its owner had deliberately failed to declare it in order to avoid tax.

“In the event that prosecutors later have evidence to prove that the individual had acquired the wealth through corruption, the law still leaves room for authorities to seize the illicit assets,” he explained.

|

| Nguyen Manh Cuong, vice-chairman of the National Assembly’s Legal Committee. Photo: National Assembly |

Counter-arguments

Nguyen Dinh Quyen, president of the National Assembly’s Institute for Legislative Research, said he disagreed with the proposal to handle suspicious wealth through administrative tax collection, as it would violate other existing laws.

“The recovery of individuals’ property must be made through court proceedings, which are the only means that is legal and constitutional,” Quyen said.

“In order to do this, we must outlaw the possession of dubious wealth,” he added.

|

| Nguyen Dinh Quyen, president of the National Assembly’s Institute for Legislative Research. Photo: Tuoi Tre |

Lawmaker Truong Trong Nghia agreed with Quyen on the shortcomings of collecting tax arrears, but said he would prefer to seize the property instead of prosecuting the owner, unless there is evidence of criminal violations.

“In my opinion, the existing law on money laundering can be applied to these cases, in which authorities are allowed to freeze and seize unexplained wealth and make it a public asset,” Nghia said.

The National Assembly will continue to review both arguments at its upcoming sessions, before the revised law is expected to be passed in late 2018.

Like us on Facebook or follow us on Twitter to get the latest news about Vietnam!