Vietnam has laid the initial foundations for domestic chip production, and the country has emerged as one of the top four Asian markets leading U.S. chip diversification, according to many local experts and enterprises.

It has made up over 10 percent of U.S. chip imports for seven straight months, according to Bloomberg.

The Southeast Asian country shipped US$562.5 million worth of chips stateside in February this year alone, up some $240.8 million year on year and ranking third in Asia in semiconductor chip exports to the U.S., following Malaysia and Taiwan.

FDI firm playground

Most exporters of chips in Vietnam in the first months of this year were foreign direct investment (FDI) enterprises, said Nguyen Van Toan, vice-chairman of Vietnam's Association of Foreign Invested Enterprises.

Giant FDI firms, such as Samsung, Intel, and Foxconn, are dominating local chip production.

In reality, Vietnamese firms find it hard to get involved in chip production. Most Vietnamese workers have participated in the assembly phase, but technologies are still held by FDI firms, Toan said.

Chip production has two key phases: chip design and production.

Large chip producers have leased land and factories and employed workers in Vietnam only. They completely own technology.

Only a few local enterprises can take part in Intel’s supply and production chain.

The increase in chip exports will benefit Vietnam but the country needs to increase the added value of its products, Toan noted.

Chip exports can improve Vietnam’s image. The Southeast Asian country will be known as an exporter of chips, not only apparel products, a technology expert said.

This proves that Vietnam can effectively attract FDI in hi-tech sectors, which is the first step to have its own chip producers instead of those completing the final phase of the chip production.

It is known that Intel makes chips in Vietnam, but in reality, the accessories and main phases are completed in Singapore and other countries before being sent to Vietnam for packaging, said Do Thi Thuy Huong, an executive board member of the Vietnam Electronic Industries Association, explaining that packaging means processing the chips in the final phase.

The products are later exported from Vietnam and labeled as made-in-Vietnam.

However, Vietnam has yet to be named on the global chip production map, Huong affirmed, adding that most electronics manufacturers and exporters are foreign-invested.

Chip production uses source technology, so it is hard to request technology transfer.

Moreover, Vietnam has to import materials for chip production, Huong said.

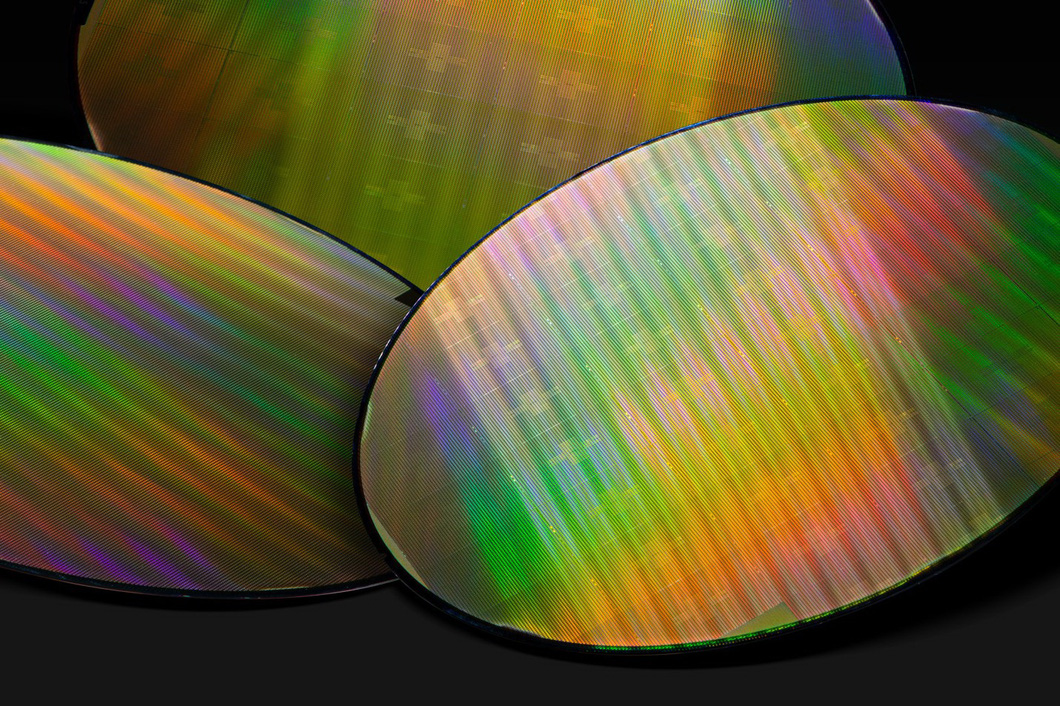

The chip production process is sophisticated, including many phases like design, producing semiconductors on wafer-thin slices of silicon used for the fabrication of integrated circuits, testing, and packaging, said Nguyen Phuc Vinh, an expert in integrated circuits.

In Vietnam, enterprises have been involved in the design, testing, and packaging phases. The country has no large semiconductor factories.

Foreign-invested firms in Vietnam, such as Intel in Ho Chi Minh City, Samsung in northern Thai Nguyen Province, and Amkor in Bac Ninh Province, also in the north, are mainly responsible for testing and packaging products.

|

|

| First wafers of FPT Semiconductor. Photo: fpt.com.vn |

Initial success of Vietnamese firms

Leading tech firms in Vietnam, such as Viettel and FPT, have forayed into semiconductor chip production, which requires cutting-edge technology.

Nguyen Vinh Quang, CEO of FPT Semiconductor, an arm of FPT Group, told Tuoi Tre (Youth) newspaper that the group successfully produced power integrated circuit chips and it is going to put them into mass production.

FPT has sent its chip samples to customers for analysis and will start to deliver the product to customers in Japan and Taiwan in June.

Meanwhile, Vietnamese military-run Viettel Group will focus on developing fifth- and sixth-generation chips, Internet of Things (IoT) and artificial intelligence (AI) apps, and military and aerospace in the next five years, Viettel chairman Tao Duc Thang said at a meeting with the prime minister early last month.

Viettel and Qualcomm also unveiled the first 5G Distributed Unit and Radio Unit powered by Qualcomm 5G RAN platforms at the Mobile World Congress 2023, held in Spain between February 27 and March 2.

This is a breakthrough opening up opportunities to change the local telecom infrastructure as it may help reduce prices and eliminate the reliance on exclusive chipsets of other manufacturers, said Nguyen Vu Ha, general director for Viettel High Technology, a unit under Viettel Group.

Local manpower development a must

It is high time to make Vietnam’s technology more attractive and lure more foreign investors to the nation thanks to high-skilled personnel, FPT Group chairman Truong Gia Binh told Prime Minister Pham Minh Chinh during the latter’s visit to FPT University and FPT Software Company Limited at Hoa Lac Hi-Tech Park in Thach That District, Hanoi last Friday.

With its human resources in AI, chip making, IoT, and big data, Vietnam can become a technology training hub of the world.

“The country may be listed among the top five or ten countries in information technology, agriculture, and tourism,” Binh said.

The prime minister, at a recent working session with the Vietnam National University-Hanoi, also required training to focus on trendy sectors in the world in which Vietnam has strengths and that match the situation in the country, particularly digital transformation, climate change response, the knowledge-based economy, the circular economy, and environmental protection.

|

|

| Employees are at work at Intel Products Vietnam. Photo: Supplied by Intel |

Intel to increase investment in Vietnam

Vietnam plays a vital part in Intel’s global manufacturing network, so the group will expand its investment in the country based on its business development demand, Kim Huat Ooi, vice-president of manufacturing and operations at Intel and general manager of Intel Products Vietnam, told Tuoi Tre.

The factory in Vietnam is the largest assembly and testing unit of Intel in the world, Kim added.

Intel ventured into the Vietnamese market in 2006 and remains the largest U.S. investor in the country’s hi-tech sector.

The presence of Intel partly helps other hi-tech investors realize the potentialities in Vietnam, Kim said.

The Intel factory in Vietnam has manufactured 3.5 billion products as of the end of last year. This is a stride in accelerating production as the figure was only two billion in early 2020.

The Vietnamese government should keep reforming some policies and administrative processes and investing in high-skilled human resources to attract more foreign investment, Kim suggested.

Like us on Facebook or follow us on Twitter to get the latest news about Vietnam!