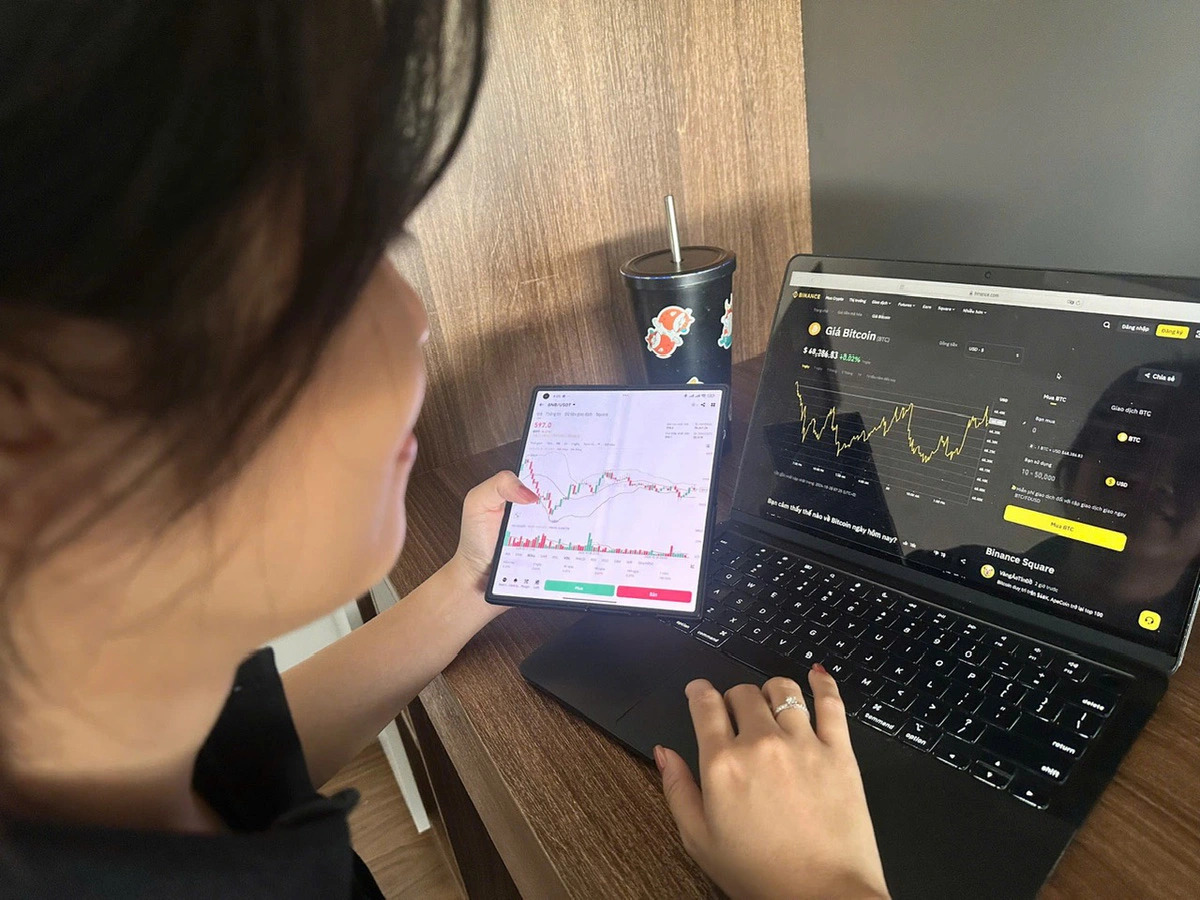

Stimulated by stories of people getting rich quickly, many Vietnamese people have rushed into cryptocurrency to change their lives but find themselves drowning in debt and sorrow.

According to statistics from U.S. blockchain analysis company Chainalysis, Vietnam has been in the top five countries with the highest level of cryptocurrency adoption globally for the last three consecutive years.

The inflow of digital assets reached US$100 billion in 2022 and $120 billion in 2023 and is forecast to steadily increase this year.

As a form of currency that exists solely in digital form, cryptocurrency is used to pay for purchases online without going through an intermediary, such as a bank, or held as an investment.

The main types of cryptocurrency according to Forbes include Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Binance coin (BNB), Solana (SOL), U.S. Dollar coin (USDC), and some others.

Broken 'get rich quick' dreams

On October 25, the unit selling price of Bitcoin peaked at $67,800, and Ethereum was traded at $2,500, marking an surge of 131 percent and 64.5 percent, respectively, from a short time earlier, according to the Binance exchange.

This sharp spike encouraged many people to rapidly invest, hoping to make huge profits and change their lives, but many of them failed and even became ruined.

Following peer pressure, Nguyen Nguyet, an office worker in District 1, Ho Chi Minh City, borrowed money from relatives, including her parents' savings account in the countryside, and invested upwards of VND500 million ($19,800).

What started off as a hopeful investment quickly turned dark and devastating.

She followed advice from friends and self-proclaimed 'experts' in the crypto community, often placing long (buy) or short (sell) orders with a leverage of up to 20-25:1.

Yet, the more she invested, the greater her losses became.

After only a few months, her entire investment evaporated.

Nguyet recalled the initial rush of seeing a profit of a few thousand U.S. dollars within 30 minutes, which drove her to invest more.

"The more I lost, the more desperate I was to recover, but in the end it was futile," she admitted.

“Now I don't know how to pay back the money I've borrowed."

N.T., a recent investor, shared how he lost 70 percent of his savings after naively believing that making a profit would be quick and easy.

“I simply thought that high leverage in cryptocurrency trading would help maximize profits, but it was a double-edged sword. When the market dropped sharply, my money also disappeared quickly," he said.

Many investors use instruments such as cryptocurrency futures, which allow them to speculate on the future price of cryptocurrencies and trade digital assets with high leverage.

While it elevates the chance of turning a profit in a short period of time, it also raises the risk if the market fluctuates strongly.

After losing a substantial amount of money, T. realized that using high leverage without solid knowledge is extremely dangerous.

"The cryptocurrency market is really volatile. If you cannot control the risks, the money you invest will evaporate real quick," T. remarked.

Another digital investor, also named T., made a fortune from trading during the COVID-19 pandemic in Vietnam.

He then spent all the profits on buying houses and cars, opening a company, and investing in many business projects.

Seeing T.'s success, his friends began trusting his ability to get rich and eagerly contributed capital to his projects, while joining him in trading.

However, less than two years later, T. suffered a loss digitally and in his business projects.

Despite this, T. enticed friends and acquaintances to donate more capital or lend him money to regain his fortune.

When he was unable to make a profit or pay back his loans, he ended up fleeing from creditors with a total loss of up to hundreds of millions of Vietnamese dong. (VND100 million = $3,945)

Scams in cryptocurrency trading

P2P (peer-to-peer) is a form of buying and selling cryptocurrencies directly between investors without going through an intermediary.

In many cryptocurrency investment communities, complaints about being scammed in P2P transactions are on the rise.

P2P transactions are a popular choice due to their convenience and cost savings, but they also come with risks.

On platforms like Binance, buyers and sellers of cryptocurrencies can freely negotiate prices without strict control from the exchange.

For example, investors wishing to buy USDT will choose their potential sellers from a basket of traders who own USDT to negotiate the transaction prices in the P2P trading space.

After buyers place a purchase order and make a bank transfer, then sellers will deliver the respective USDT amounts.

Transactions between buyers and sellers on crypto exchanges are almost entirely based on trust, with little control from the exchanges, therefore rendering it extremely risky for the buyers.

In addition, crypto sellers often avoid being tracked by authorities by asking their buyers not to label payments with ‘purchase of crypto’ in their bank transfers.

As a result, there have been cases in which buyers knew they had been scammed only after transferring amounts ranging from VND30 million ($1,184) to billions of Vietnamese dong, and they could do nothing to recover the lost money. (VND1 billion = $39,426)

In addition, some sellers created counterfeit websites or fake crypto transfer forms to trick buyers through the P2P trading space.

Tuyen, an investor in Ho Chi Minh City’s Go Vap District, was a victim of a P2P transaction.

"After transferring more than VND40 million [$1,581], I realized that the USDT amount I received did not match the money sent," he recalled.

“I immediately tried to contact the seller again, but he blocked all means of communication."

Legal framework needed for digital currency management

According to a report by U.S.-based TRM Labs, a leading blockchain intelligence firm, the severity of cryptocurrencies stolen globally in cyberattacks reached $1.38 billion in the first half of 2024, more than double that of the same period last year.

One of the biggest cyber attacks this year was the theft of nearly $308 million in Bitcoin from the Japanese exchange DMM Bitcoin.

Another report from U.S.-based CertiK, a leading blockchain security company, shows that the cryptocurrency and decentralized finance (DeFi) sector lost $1.19 billion in January-June.

Among the reported cyber intrusions, phishing attacks caused the most damage, with $497.7 million in cryptocurrency stolen.

Against rising risks and fraud in the cryptocurrency market, financial experts have stressed that building a clear, specific legal framework is necessary to protect investors and prevent fraudulent activities in Vietnam.

At a seminar in August to discuss digital assets and corporate responsibilities, speakers emphasized the need for digital asset management and related tax obligations.

Dau Anh Tuan, deputy secretary general of the Vietnam Chamber of Commerce and Industry, stressed that Vietnam needs to introduce a complete legal framework for digital assets to ensure the market develops in an orderly and transparent manner and to protect the rights and interests of investors.

"Without a legal framework, transactions involving virtual assets are risky, leaving those involved unprotected," he said.

"This creates an urgent need for regulations governing digital assets and related transactions."

Earlier in February, Prime Minister Pham Minh Chinh signed off on a national action plan for anti-money laundering, including a framework to monitor virtual assets.

The Ministry of Finance has been assigned to develop and complete a legal framework governing virtual assets and providers of virtual asset services by May 2025 to help protect investors from risks and facilitate the development of the cryptocurrency market in Vietnam.

Like us on Facebook or follow us on Twitter to get the latest news about Vietnam!