SYDNEY/SINGAPORE -- Japanese stocks jumped at the open on Tuesday, underpinning a recovery across battered Asian share markets and even triggering circuit breakers in some, after central bank officials said all the right things to soothe investor nerves.

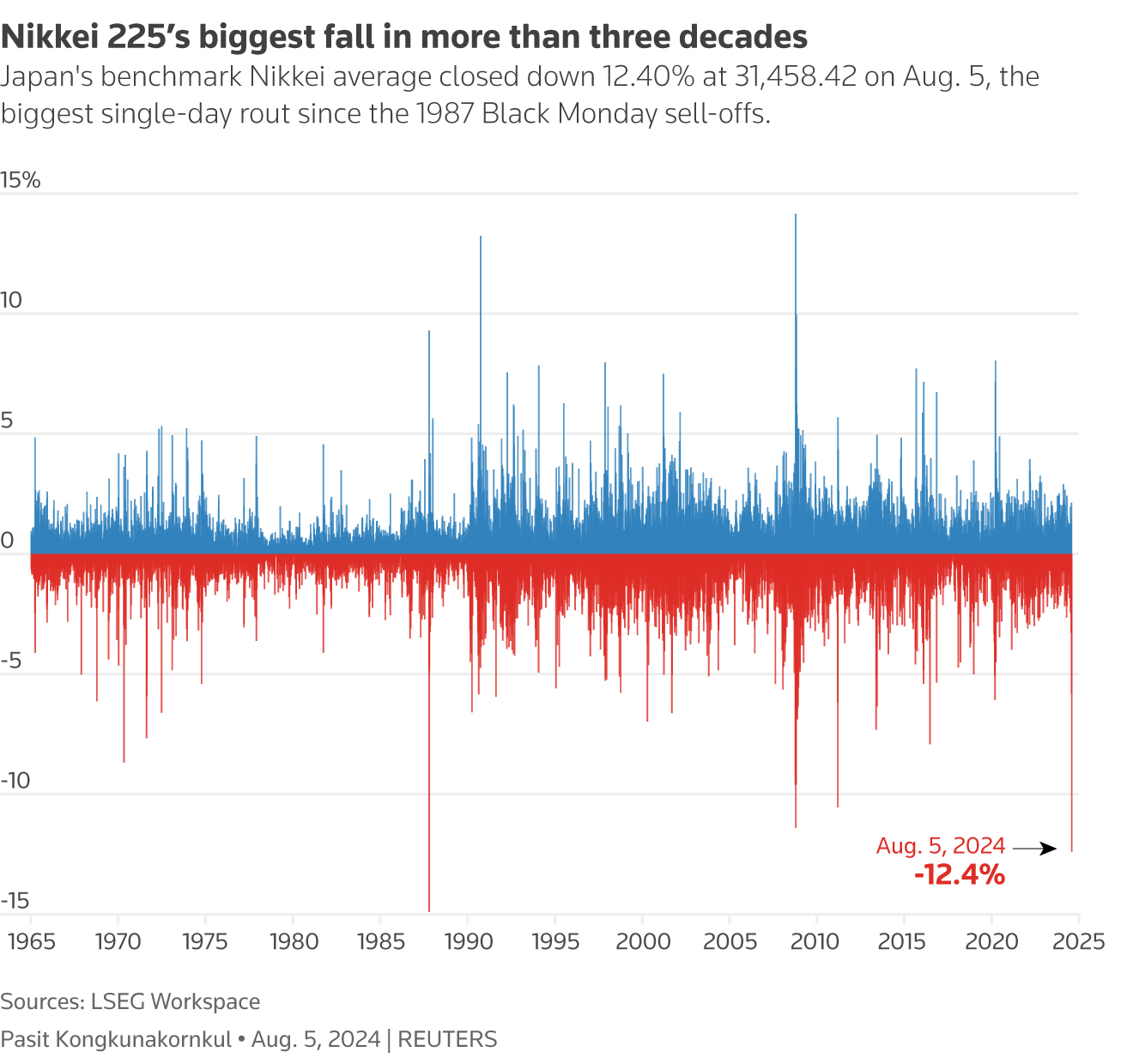

The Nikkei (.N225) soared more than 8% to above 34,000 in the opening minutes of trading, rebounding sharply from its 31,458 close on Monday. The index had plummeted 12.4% in its worst selloff since the 1987 Black Monday crash.

Wall Street also looked steadier with S&P 500 futures rebounding 0.9% in early trade, while Nasdaq futures rose 1.2%. The S&P 500 (.SPX) had lost 3.00% over Monday, with the Nasdaq Composite (.IXIC) down 3.43%.

"After the breathtaking and historic moves seen across Asian markets yesterday, driven predominantly by a significant liquidation of margin positions, we look for a solid counter rally on open today," said Chris Weston, head of research at broker Pepperstone.

However, he cautioned that the level of implied volatility for the Nikkei was at a stratospheric 70%, suggesting fireworks were likely for some time yet.

"After such a furious shake-out of leveraged positioning, with Japanese banks absolutely taken to the cleaners, it will take the bravest of investors to buy with any conviction."

Currencies also seemed to be reversing some of Monday's sharp moves, as the dollar edged up to 145.64 yen, having sunk 1.5% on Monday to as deep as 141.675. The yen has shot higher in recent sessions as investors were squeezed out of carry trades, where they borrowed yen at low rates to buy higher yielding assets.

The dollar pared its losses on the safe-haven Swiss franc, holding at 0.8546 francs from a low of 0.8430.

Treasury yields had also come off their lows, in part in reaction to a rebound in the U.S. ISM services index to 51.4 for July. In particular, it employment index jumped 5 points to 51.1, suggesting last week's payrolls report may have overstated the weakness in the labour market.

"Gauging the bottom of such historic selloffs is complicated and investors will most likely remain cautious before pouring capital back into equity markets," said Boris Kovacevic, Austria-based global macro strategist at payments firm Convera.

"However, the dollar-yen pair has now fallen 12% since peaking five weeks ago and is in highly oversold territory. The yen is therefore vulnerable to any upside surprises in U.S. macro data leading investors to reconsider the recession trade. This would help Japanese equities stabilize," he said.

Yields on 10-year Treasury notes were back at 3.84%, having been as low as 3.667% at one stage.

|

|

| A man walks under an electronic screen showing Japan's Nikkei share price index inside a conference hall in Tokyo, Japan June 14, 2022. Photo: Reuters |

Federal Reserve officials did their best to reassure markets with Fed San Francisco President Mary Daly saying it was "extremely important" to prevent the labor market tipping into a downturn.

Daly added that her mind was open to cutting interest rates as necessary and policy needed to be proactive.

The comments underpinned market expectations that the Fed would cut by 50 basis points at its September meeting, with futures implying an 87% chance of such an outsized move.

The market has around 115 basis points of easing priced in for this year, and a similar amount for 2025.

In precious metals, gold failed to get a safe haven bid amid talk investors were taking profits to cover losses elsewhere. Spot gold stood at $2,409 an ounce after losing 1.52% overnight.

In energy markets, oil prices bounced early Tuesday as news that several U.S. personnel were injured in an attack against a military base in Iraq stoked fears of a wider conflict.

U.S. West Texas Intermediate crude futures CLc1 climbed $1.18, or 1.6%, to $74.12 per barrel.

|

| Japan's benchmark Nikkei average closed down 12.40% at 31,458.42 on August 5, the biggest single-day rout since the 1987 Black Monday sell-offs. |