Japan's current account surplus jumped to a record last year, data from the finance ministry showed on Monday, as a weaker yen boosted returns on foreign investments that helped to comfortably offset a trade deficit.

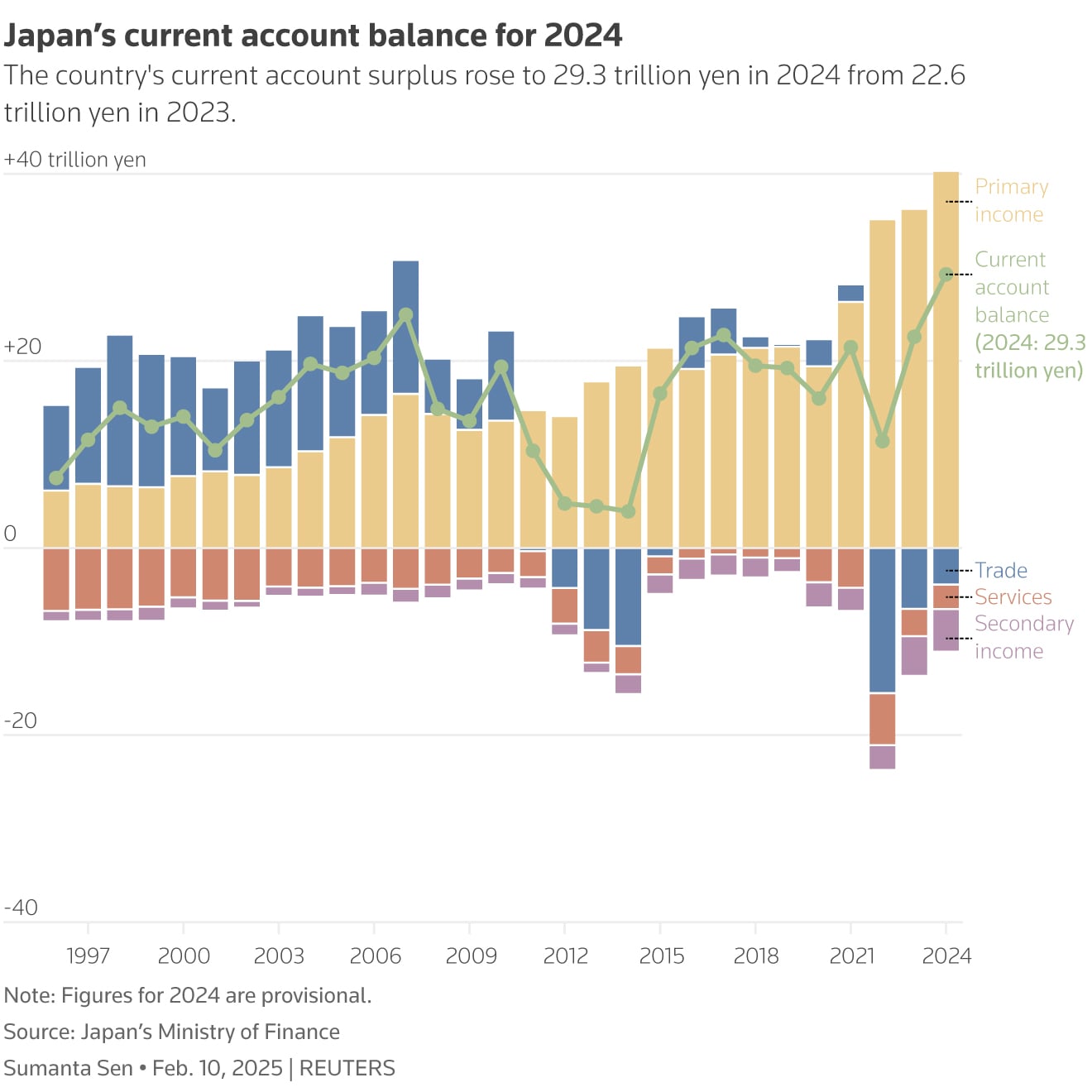

The surplus in the current account stood at 29.3 trillion yen ($192.67 billion) in 2024, the largest since comparable data became available in 1985. It represented a 29.5% increase from the previous year.

|

|

| The combination chart shows Japan’s current account balance as a line and the country’s primary income, trade, services and secondary income as stacked bars. |

Primary income from securities and direct investment overseas remained the biggest driver with a record 40.2 trillion yen in surplus, as Japanese companies pursue growth abroad, including acquisitions of foreign firms.

The trade deficit narrowed by 40% to 3.9 trillion yen on brisk exports of automobiles and chipmaking equipment as well as lower costs of energy imports.

The surplus from travel rose to 5.9 trillion yen, reflecting thriving inbound tourism.

For December, Japan's current account surplus stood at 1.08 trillion yen, down from the previous month's 3.35 trillion yen.

The country's current account surplus was once considered a sign of export might and a source of confidence in the safe-haven yen.

But the composition has changed over the last decade with trade no longer generating a surplus due to a surge in the cost of energy imports and an increase in offshore manufacturing by Japanese companies.

Japan now offsets the trade deficit with the robust primary income surplus, which includes interest payments and dividends from past investments overseas.

But the bulk of such income earned overseas is re-invested abroad instead of being converted into yen and repatriated home, which analysts say may be keeping the Japanese currency weak.

"There is no reason to repatriate because overseas investments yield higher returns than at home," said Norinchukin Research Institute chief economist Takeshi Minami.

Japan is now facing pressure from the United States, its largest export destination, to close its $68.5 billion annual trade surplus, a call that President Donald Trump made during Prime Minister Shigeru Ishiba's first White House visit on Friday.

($1 = 151.5700 yen)