Boeing set out to shore up its sagging finances on Tuesday, announcing plans to raise up to $25 billion through stock and debt offerings and a $10 billion credit agreement with major lenders amid a production and regulatory crisis.

It was not clear when and how much the planemaker would eventually raise, but analysts estimate Boeing needs somewhere between $10 billion and $15 billion to maintain its credit ratings, which are now just one notch above junk.

Boeing has lurched from crisis to crisis this year, kicking off on Jan. 5 when a door panel blew off a 737 MAX jet in mid-air. Since then, its CEO departed, its production has been slowed as regulators investigate its safety culture, and in September, 33,000 union workers went on strike.

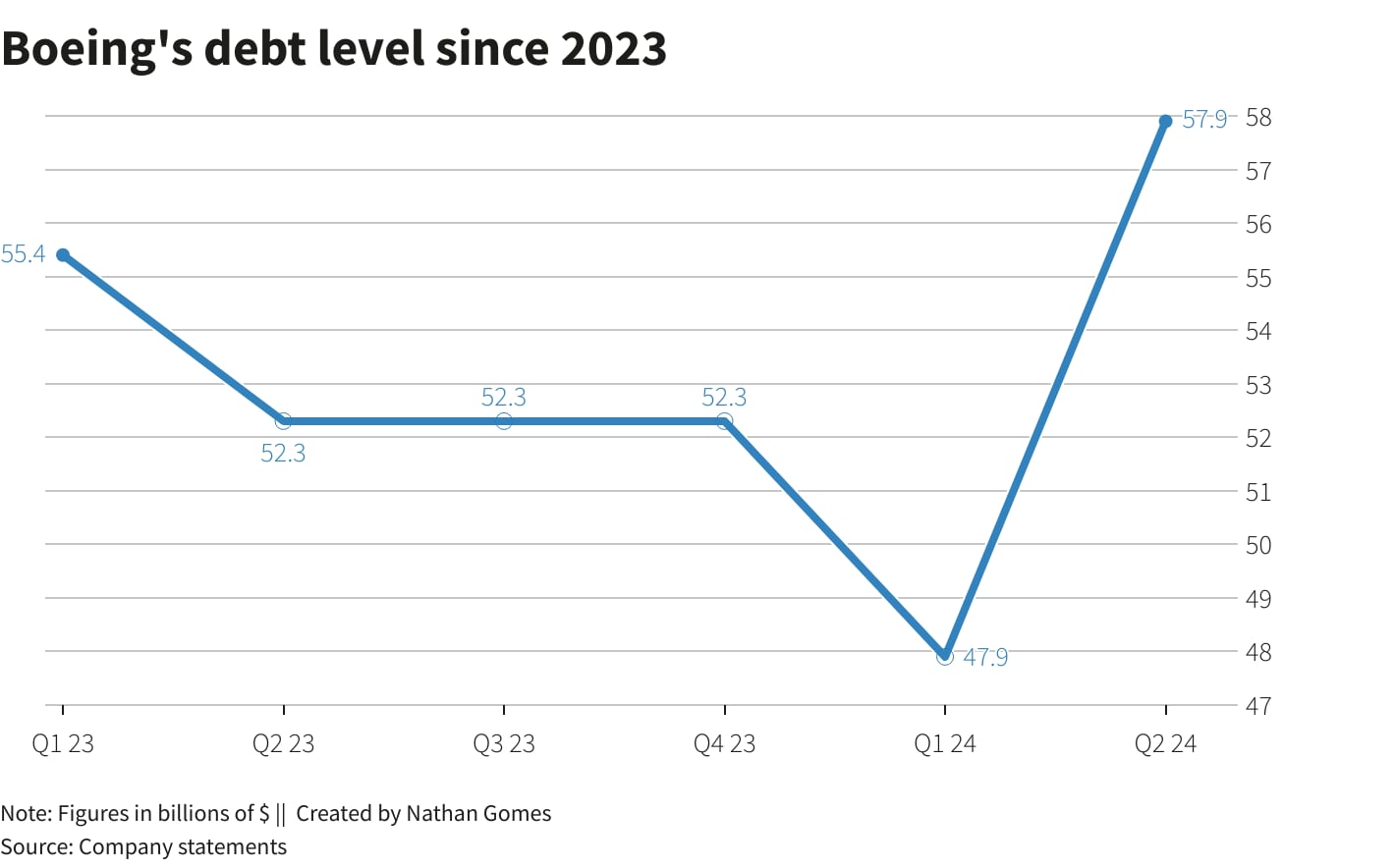

The company is looking to shore up its finances with a cash-and-debt raise as it faces the possibility that its credit rating will be lowered after three straight quarters of burning through cash.

The strike is costing roughly $1 billion a month, according to one analyst estimate, and to reduce costs the planemaker has also said it would cut 17,000 jobs.

The company's shares were up 2.1% on Tuesday.

S&P Global and Fitch warned of a downgrade last month. The ratings agencies said on Tuesday that the stock and debt sales could help preserve Boeing's investment-grade rating.

"The supplemental credit facility also seems like a sensible precaution," S&P Global's Ben Tsocanos said.

However, some analysts were not convinced.

"We take the vagueness and breadth of the shelf announcement and the need for the temporary financing as implying that the banks are struggling to sell this issue to potential investors or lenders," said Agency Partners analyst Nick Cunningham, who suspended his recommendation and price target for Boeing's shares.

Boeing said on Tuesday it had not drawn on the new $10 billion credit facility, arranged by BofA, Citibank, Goldman Sachs and JPMorgan, or its existing revolving credit facility.

"These are two prudent steps to support the company's access to liquidity," Boeing said, adding that the potential stock and debt offerings will provide options to support its balance sheet over a three-year period.

On Monday, Emirates Airlines President Tim Clark became the first senior industry figure to articulate fears over Boeing's ability to tackle its worst-ever crisis intact.

"Unless the company is able to raise funds through a rights issue, I see an imminent investment downgrade with Chapter 11 looming on the horizon," Clark told the Air Current, an aviation industry publication.

Boeing will use the funds for general corporate purposes, according to paperwork filed with the U.S. markets regulator on Tuesday.

The planemaker had cash and cash equivalents of $10.89 billion as of June 30.

|

|

| Boeing's debt over the past year |

Maturing debt

The company and the Machinists union, which represents the striking workers in the U.S. Pacific Northwest, are yet to reach an agreement over a new contract and talks have become increasingly heated.

U.S. Acting Labor Secretary Julie Su met with Boeing and the union in Seattle on Monday in a bid to break the deadlock.

The planemaker was already reeling due to a regulator-imposed cap on production of its MAX jets after the mid-air cabin-panel blowout in January.

Boeing has $11.5 billion of debt maturing through Feb. 1, 2026, and has committed to issuing $4.7 billion of its shares to acquire Spirit AeroSystems and assume its debt.

Boeing delivered 33 jets in September, down from 40 in August, as it slipped further in the delivery race with rival Airbus.