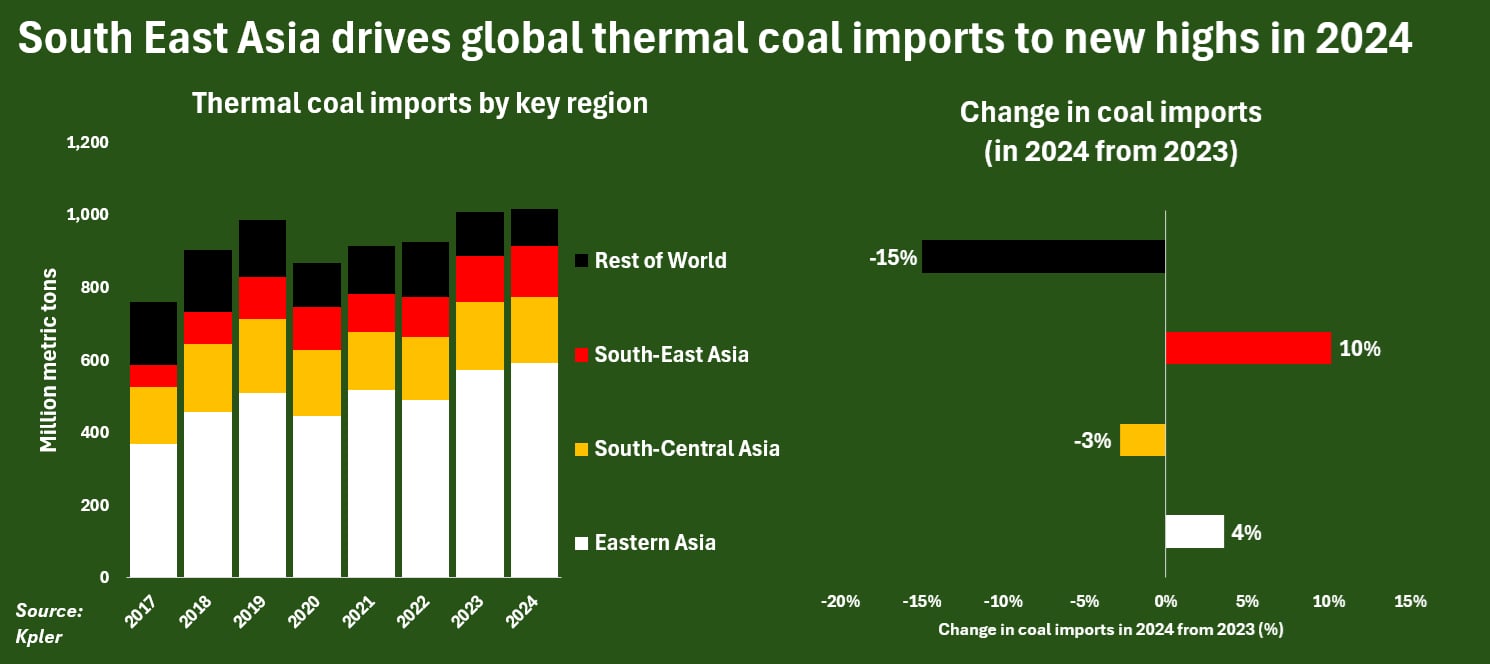

Vietnam has become a key driver of global growth in thermal coal imports and use, after supercharging imports of the power fuel by over 30% in 2024 to record highs.

Vietnam's imports of thermal coal rose 31% to 44 million metric tons in 2024, according to ship-tracking firm Kpler, which contrasts with just a 1% expansion in global thermal coal imports last year to 1.01 billion tons.

An enduring boom in Vietnam's export-oriented and power-hungry manufacturing sector has been the main catalyst behind the surge in its imports and use of coal, which is the country's largest source of power.

The growth rate of Vietnam's coal purchases in 2024 far exceeded the 11% rise in imports by China, the world's largest coal consumer, and ensured that Southeast Asia registered the largest rise in coal imports among all regions last year.

|

|

| South East Asia drives global thermal coal imports to new highs in 2024 |

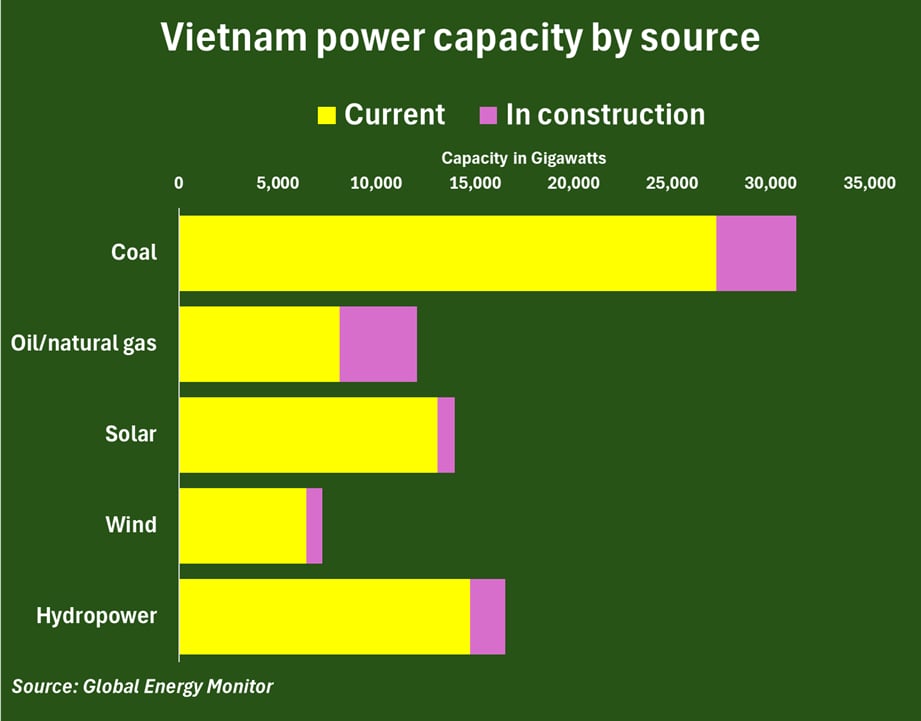

And Vietnam's coal consumption is on track to keep growing, as the country's coal-burning capacity will rise by a further 15% once projects under construction are completed.

That expanded coal capacity will likely ensure that global coal-fired power emissions will continue to grow over the coming years, even as coal burning steadily contracts outside of Asia.

Coal dependence

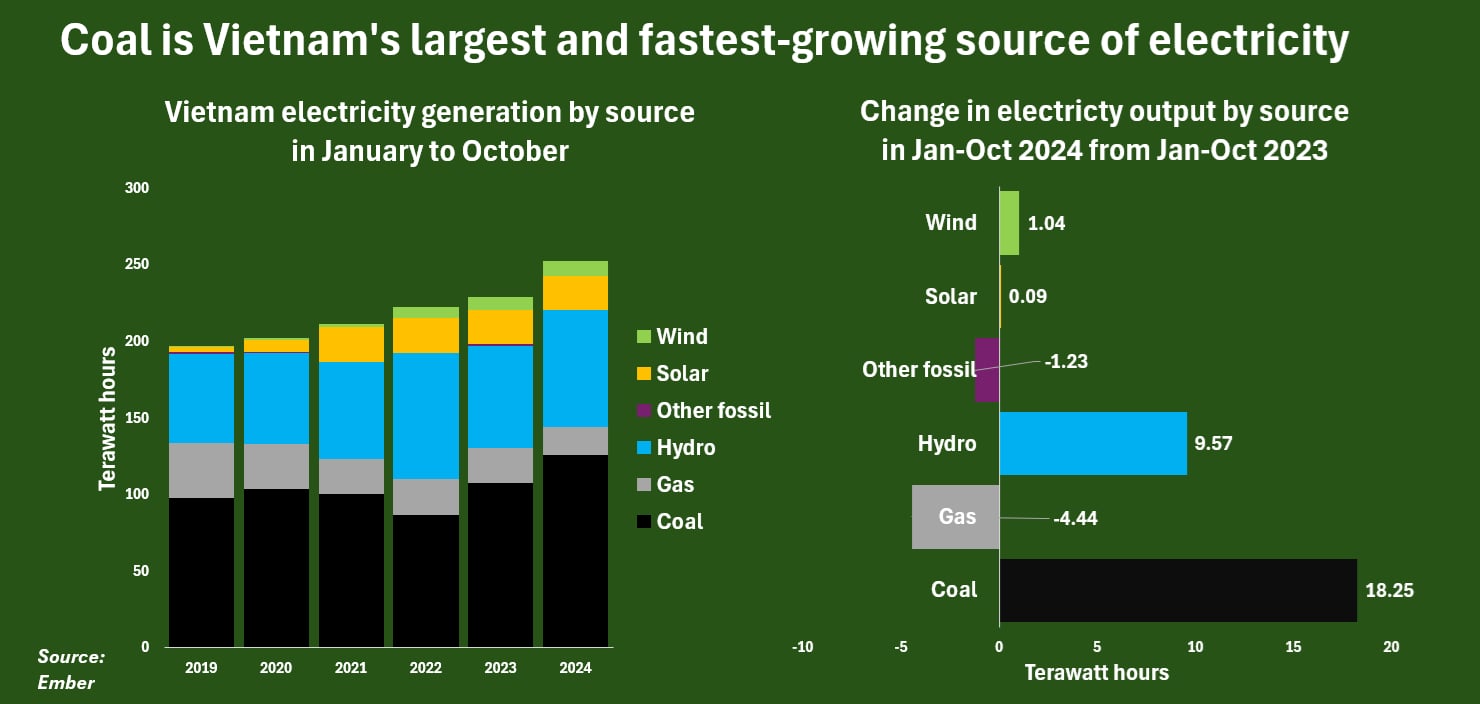

Coal-fired power stations generated half of Vietnam's electricity from January to October in 2024, according to Ember, which is Vietnam's largest coal share since 2020.

Total coal-fired generation expanded by 17% from January to October 2023, and helped drive total electricity supplies up by 10% on the year to a new high.

|

|

| Coal is Vietnam's largest and fastest-growing source of electricity |

Of the total current installed generation capacity of around 70,000 GW, coal has the largest footprint with around 39%, or 27,239 gigawatts, according to Global Energy Monitor (GEM).

Hydropower has the next largest generation share of 21% (14,750 GW), while solar farms have around a 19% share (13,100 GW).

Natural gas and fuel-oil plants have around a 12% share (8,150 GW), and wind farms have a 9% share (6,500 GW).

There is roughly 11,600 GW of new generation capacity under construction in Vietnam, and coal and gas-fired generation are both set to grow by around 4,000 GW.

|

|

| Vietnam power capacity by source |

There is a combined 3,500 GW of new solar, wind and hydro capacity also being built, GEM data shows.

As coal and gas-fired power capacity account for around 70% of the total capacity under construction, Vietnam's fossil fuel-fired power footprint will increase from around 51% currently to 53.3% once the current capacity under construction is complete.

Regional norms

While Vietnam's expanding footprint of fossil fuel generation contrasts with planned capacity changes in Europe and the United States, heavy fossil fuel reliance remains the norm across Southeast Asia.

Indeed, fossil fuels have a 71% share of current power generation capacity in Southeast Asia as a whole, and around a 60% share of the capacity under construction.

And a key driver of that fossil fuel dependence is the strong growth rates of several economies across the region, and the large and rapidly growing workforces in most Southeast Asian countries.

Indonesia, the Philippines and Vietnam all have populations in excess of 100 million, and average gross domestic product growth rates of nearly twice the expected global average of 3.2% in 2025, according to the International Monetary Fund.

Leading role

Vietnam's economy has grown by an average of 5.6% a year since 2018, which is by far the fastest growth pace among all Southeast Asian nations during that period.

Key to Vietnam's success has been a major rerouting of manufacturing supply chains out of China and into other low-cost production hubs since U.S. President Donald Trump kicked off a trade war with China during his first term.

Vietnam's strong global trade route connections and fast-developing experience with an array of manufacturing processes made it ideal for companies looking to quickly reduce production bases within China but maintain a presence in Asia.

However, the speedy expansion in Vietnam's production of manufactured goods resulted in a sharp rise in energy consumption, which in turn required local power firms to boost power supplies by whatever means necessary.

Vietnam's total electricity demand jumped by 27% from 2018 to 2023, according to Ember.

That growth pace exceeds the 23% rise in Indonesia and a 12% rise in the Philippines and globally over the same period, and placed sustained pressure on Vietnam's energy suppliers.

The relentless growth in power consumption triggered frequent power outages in recent years, especially during heatwaves when demand for cooling systems soared.

To fend off further power issues, Vietnam's energy suppliers have prioritised stability and cost efficiency as they have expanded generation, which in turn has triggered the continued strong dependence on coal as the main source of power.

The country's energy firms also plan to increase generation capacity from renewables and other clean power sources between 2030 and 2050.

But over the nearer term, coal remains Vietnam's power fuel of choice, and its use will continue to grow alongside the country's overall economy for the foreseeable future.

**The opinions expressed here are those of the author, Gavin Maguire, a market analyst for Reuters.